Editor's note: In 2022, Aidvantage took over for Navient for federal student loans. Additionally, Navient announced on January 13, 2022, that they had reached a settlement with 39 state Attorneys General, providing $1.7 billion in forgiveness to some borrowers with private student loans held by the company. The private student loans were mostly issued by Sallie Mae before 2010, and virtually all of them were in default. You could be eligible if you owe private student loans to Navient that are currently in default that you borrowed before 2010. In addition, 350,000 borrowers with federal loans serviced by Navient who were steered into forbearance will receive an average payment of $260. We include the full details of who qualifies and when to expect relief in the article below.

Navient has consistently ranked as one of the most disliked student loan servicers among borrowers. There are also several Navient lawsuits that contend the servicer’s missteps have indeed entered into criminal territory. With so many customer service and repayment guidance complaints, student loan borrowers need to be aware of options for Navient student loan forgiveness.

Get Started With Our New IDR Calculator

Here’s a quick update on major happenings with Navient.

- There have been several Navient lawsuits that contend the servicer’s missteps have indeed entered into criminal territory. A major settlement was reached in January 2022 that includes $1.7 billion in private student loan debt cancellation and $95 million in restitution payments to certain federal student loan borrowers.

- In September 2021, Navient announced its desired departure from the student loan servicing business, with plans to transfer its six million federal borrower accounts to a company called Maximus Education. However, Maximus created a subsidiary called Aidvantage, which will now be the official student loan servicer for those who were previously stuck with Navient.

It’s important to understand there are no exclusive Navient student loan forgiveness programs. However, there are many general student loan forgiveness programs that Navient borrowers may be eligible for. Additionally, some student loan borrowers might be automatically eligible for loan cancellation or restitution payments due to the recent settlement.

Let’s take a look at the Navient loan forgiveness options available today.

What kind of Navient student loans do you have?

Despite once being the same company, Navient and Sallie Mae are now completely separate organizations. Navient loan forgiveness is not the same as Sallie Mae loan forgiveness.

Because of its history with Sallie Mae, however, Navient services a mix of private and federal student loans. You’ll want to know which kind you have. It makes a big difference in terms of which forgiveness programs you qualify for.

To find out what kind of student loans you have with Navient, you can contact them directly or conduct a “Financial Review” on the National Student Loan Data System (NSLDS).

If you have federal student loan debt, those loans will be eligible for federal forgiveness programs like Public Service Loan Forgiveness (PSLF Program). But private student loans won’t be. Private student loans may be eligible for forgiveness through state or profession-specific student loan forgiveness programs. For a full list of programs, check out the Ultimate Guide to Student Loan Forgiveness.

Navient loan cancellation and restitution payments: 2022 settlement details

On January 13, 2022, a major settlement was announced that will provide “relief totaling $1.85 billion to resolve allegations of widespread unfair and deceptive student loan servicing practices and abuses in originating predatory student loans”, according to the Pennsylvania Attorney General.

Although the settlement allows Navient to dodge any admission of misconduct, it requires Navient to:

- Cancel the remaining balances on $1.7 billion in subprime private student loan balances owed by more than 66,000 borrowers.

- Provide $95 million in restitution payments to approximately 350,000 federal loan borrowers who were steered into long-term forbearance, equaling about $260 each.

- Pay $142.5 million to the attorney generals.

- Conduct various internal reforms aimed at benefiting student loan borrowers.

If you qualify for loan cancellation under this settlement, you’ll be automatically notified by Navient by July 2022. You should receive a refund for any payments made on the canceled debt after June 30, 2021.

If you’re eligible for restitution payments, be sure to update your address and contact information within your StudentAid.gov account from the U.S. Department of Education. You should receive a postcard in the mail from the settlement administrator sometime in spring 2022.

Who qualifies for Navient settlement benefits?

Although you don't have to do anything to receive loan cancellation or restitution payments under the Navient settlement, you might still be wondering if you qualify.

Here's a brief summary, including images from the “Common Questions” section of the Navient Multi-State Settlement informational website.

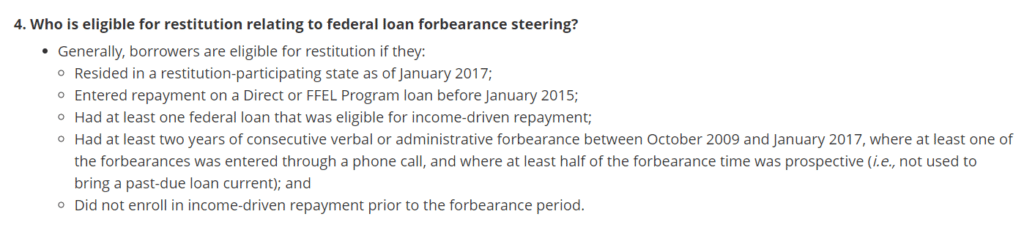

- Restitution eligibility. Federal loan borrowers who were placed in long-term forbearances instead of income-driven repayment plans (IDR plans). Must have been a resident of one of the following participating states or had an address with a military postal code as of January 2017: AZ, CA, CO, CT, DC, DE, FL, GA, HI, IA, IL, IN, KY, LA, MA, MD, ME, MN, MO, NC, NE, NJ, NM, NV, NY, OH, OR, PA, TN, VA, WA, and WI.

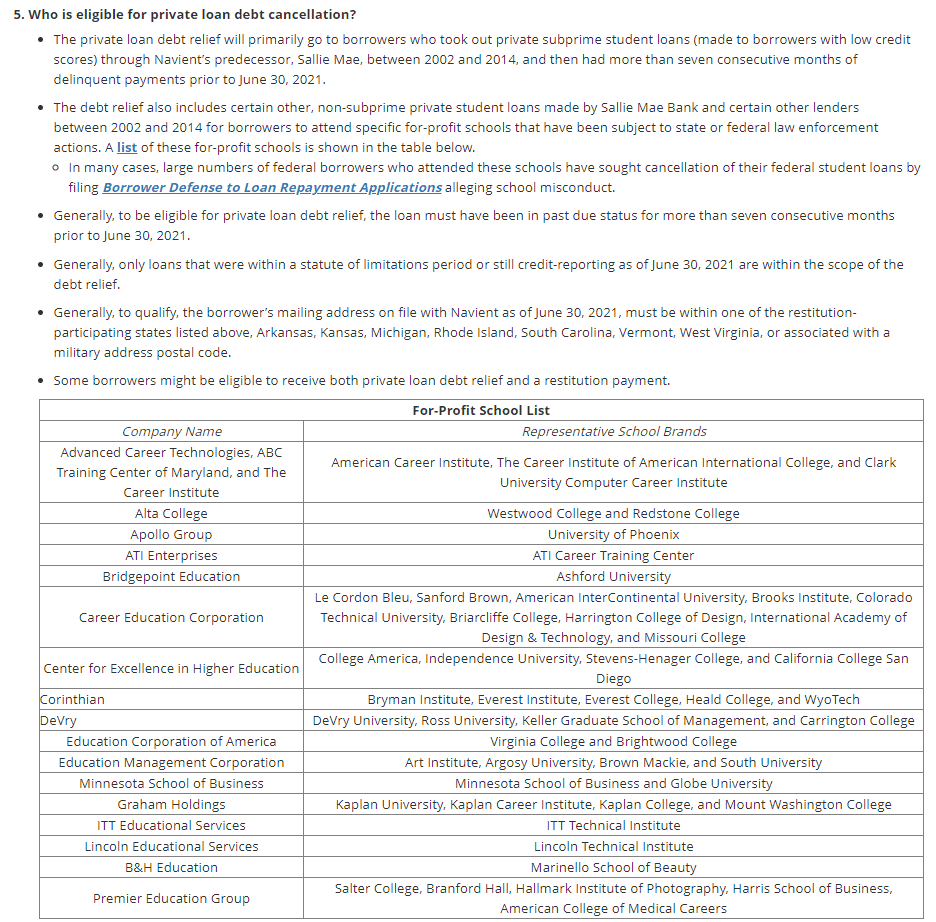

- Loan cancellation eligibility. Private student loan borrowers who took out subprime loans with Sallie Mae between 2002 and 2014, and then had more than seven consecutive months of delinquent payments. Must have mailing address on file with Navient as of June 30, 2021, with one of the above participating states or AR, KS, MI, RI, SC, VT or WV.

Navient student loan forgiveness for federal loans now at Aidvantage

If you had federal student loans with Navient, they are likely now with Aidvantage. Here are several forgiveness options that are available to you.

1. Income-driven repayment (IDR) forgiveness

Currently, the Office of Federal Student Aid at the Department of Education offers four income-driven repayment plans for its loans.

- Pay As You Earn (PAYE) Plan

- Saving on a Valuable Education (SAVE), formerly REPAYE, Plan

- Income-Based Repayment (IBR) Plan

- Income-Contingent Repayment (ICR) Plan

By taking advantage of these income-driven repayment plans, you may be able to lower your monthly payment amount. Plus, you may be eligible to receive Navient student loan forgiveness once you reach the end of your repayment schedule.

Depending on the plan that you choose, you’ll be eligible for forgiveness in 20 to 25 years. But you’ll want to stay vigilant to make sure that your federal student loan payments are being handled correctly. And you’ll need to recertify your income and family size each year.

And keep in mind, if you do receive forgiveness, you’ll owe income tax on the forgiven amount. So if income-driven repayment (IDR) forgiveness is your strategy, make sure to save a little money each year for the tax bill that’s coming down the road.

2. Public Service Loan Forgiveness (PSLF)

If you work for a qualifying employer in the public sector, such as the government or a non-profit organization, the Public Service Loan Forgiveness program is probably your best student loan forgiveness option. With PSLF, you can earn tax-free student loan forgiveness in as little as 10 years (or 120 qualifying student loan payments).

It should be pointed out that the Department of Education has selected FedLoan Servicing as the exclusive servicer of the Public Service Loan Forgiveness program. This means you can only qualify for this program if FedLoan is your servicer. But don’t worry if you’re with Navient right now.

You can apply for PSLF on the StudentAid.gov website. If you’re accepted to the program, Navient will automatically transfer your federal student loans to FedLoan Servicing. The Department of Education says that it will notify you if you’ve been accepted to the program. But if it’s taking longer than you think is reasonable to get an answer, you can call FedLoan Servicing at 1-855-265-4038 to ask for a status update.

Note that Parent PLUS Loans don't qualify for PSLF. However, Parent PLUS borrowers can become eligible by taking out a Direct Consolidation Loan. It's also important to understand that, with Parent PLUS Loans, it's the parent's employment that must qualify for PSLF, not the student's.

3. Teacher Loan Forgiveness

Teachers might be eligible for up to $17,500 of Navient student loan forgiveness through the Teacher Loan Forgiveness Program.

But to qualify, you’ll need to be considered a “highly qualified” teacher by the Federal Student Aid office at the Department of Education. And you’ll need to teach five consecutive academic years in a low-income elementary school, secondary school, or educational service agency.

It’s important to point out that PSLF and Teacher Loan Forgiveness don’t mix well. In many cases, you might be better off sticking with PSLF.

4. Loan Discharge

This isn't technically a “forgiveness” option. But it should be noted that there are several ways that federal student loan borrowers can become eligible to have their student loans discharged.

One example is Total and Permanent Disability (TPD) discharge. To qualify for TPD discharge, you'll need to provide medical documentation of your disability. Eligible loans for Total and Permanent Disability (TPD) discharge include Direct Loans, FFEL loans, and Perkins Loans.

The Federal Student Aid Office will also discharge your student loans if you die or, in the case of a Parent PLUS Loan, your parent dies. Other federal discharge options include closed school discharge, false certification or unauthorized payment discharge, and borrower defense discharge.

Get rid of Navient or Aidvantage by refinancing

If you have private student loans and don’t qualify for any of the above student loan cancellation programs — or even if you do — you may want to consider refinancing your Navient student loans. By refinancing, you could kill two birds with one stone.

It’s your chance to kick Navient to the curb, and you may save money on student loan interest, too. So, while refinancing isn’t student loan forgiveness, it could be your best Navient student loan strategy.

But how can student loan borrowers know when refinancing is the right move? Here are three questions to ask yourself:

1. Will you be eligible for federal forgiveness soon?

If you’re just starting student loan repayment, refinancing could save you a lot of money over the life of your loans.

But if you’ve already made three years of federal student loan payments toward Teacher Loan Forgiveness or five years toward Public Service Loan Forgiveness while working full-time, that changes the discussion completely. If you’re already well on your path toward earning Navient student loan forgiveness through a federal program, you should avoid refinancing with any private lenders.

If you do choose to stay with Navient, make sure you’re on the right repayment plan and filing your taxes the right way. You should also be vigilant in making sure that Navient is handling your loans correctly. If your loans are in default with Navient, you may need to reach out to a student loan attorney.

2. What is your financial situation?

When you refinance federal student loans, you become ineligible to base your monthly payment amount on your income or to apply for federal forbearance or deferment. Your loan type changes from federal to private. So in other words, federal student loan borrowers will have less payment flexibility with private student loans. Rain or shine, the bills will just keep on coming — while federal borrowers have taken advantage of the recent payment pause and are hoping for Biden's debt relief to go through.

So, do you have an emergency fund in place? If not, you may want to reach that goal before refinancing federal student loans.

There are two other financial factors to consider: your credit score and debt-to-income ratio. If you have a credit score over 650 and you owe less than 1.5 times your income, you could be a prime candidate for refinancing. Otherwise, you may want to stick with the loans you received from the Federal Student Aid office.

3. Have you achieved career stability?

If you only expect your income to grow over the next few years, refinancing could be a great move. Income-driven repayment plans will become progressively less helpful as you make more money. Plus, you’ll be shackled to your student loans for 20 years or more, and you’ll pay a lot more in interest.

But if your job situation is unstable, you may want to stick with federal student loans since they provide more repayment options. Knowing that income-driven repayment (IDR) is available if you were to need it can be a comfort. And if your job situation stabilizes, you can always refinance later.

Save money and hassle

Wondering if refinancing is worth it? Consider this. Let’s say you had $100,000 in student loans at 6.5% interest rate. Let’s also say that you chose to stay on the Standard 10-Year Repayment Plan. In that case, you’d pay $36,257 in interest over the life of your loans.

But by refinancing to private student loans at 3.5%, your interest cost would drop to $18,663. That’s a savings of over $17,500. Plus, you’d have a lower monthly payment amount along the way and would be free of Navient and its problems. Just make sure to review your credit report and score to see if you qualify.

If you’re thinking about refinancing your Navient student loans, Student Loan Planner® can help you find a great deal. By taking smaller payouts than our competitors for our referral links, we’re able to offer our readers some of the highest cash bonuses available online.

Depending on your student loan balance, you may be eligible to earn a $350 to $1,275 cash-back bonus. See how much you could save!

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

Fixed 5.24 - 9.99% APR*

Variable 6.24 - 9.99% APR*

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 5.19 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 5.19 - 9.74% APR

Variable 5.99 - 9.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 5.44 - 9.75% APR

Variable 5.49 - 9.95% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 5.48 - 8.69% APR

Variable 5.28 - 8.99% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 5.48 - 10.98% APR

Variable 5.28 - 12.41% AR

|

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

My Granddaughter had a student loan and I was the co-signer. She has received loan forgiveness, however, the loan was put in my name alone. I was not notified that any of this was happening. I am 85 years old. I did not foresee her becoming disabled any more than she saw herself becoming totally disabled. What is my recourse??

She may have had a mix of federal and private loans. Federal loans have forgiveness programs, but private loans don’t usually offer forgiveness. If you’re a cosigner, it’s probably a private loan. I’d recommend you contact the lender to find out what happened.

I started out with a loan through Sallie Mae, then switched over to Navient. Navient kept pushing me into forbearance, now they have ruined my credit score and taked on 5,000 in interest, what dcan I do

Hey Marty, sorry to learn this. Here are 107 ways to pay off student loans faster. Depending on what type of student loans you have, either federal or private, our site has blog on how to best approach them. In any case, here are 5 resources you should be aware of when paying off student debt.

I have a bizarre situation. My financial statements while in school stated that my tuition was $58,850. My total grant funding was $27,395. On my financial statement, all 4 loans (Perkins, SUB, UNSUB, Parent Plus) totaled $41,172. After I’d graduated I had $75,000 in loans, which my financial statement did not show during attending school. My school is in several lawsuits for false claims and have been investigated. I’m not sure how to proceed, especially since most Student loan forgiveness applications are being denied now.

I’d refer you to a student loan lawyer like Jay, Josh, Adam, or Stanley. Here’s their emails below. Each specializes in a different area of the country and in different areas of student loan law:

Jay (all cases in Cali, West Coast, NY + all default cases): jay@moneywiselaw.com

Josh (all cases in New England ex-Massachusetts): jcohen@thestudentloanlawyer.com

Adam (Massachusetts + loan servicer issues): asminsky@minsky-law.com

Stanley (covers huge swath of Midwest and South): TATE@tateesq.com

I have all federal student loans and im trying to see about loan forgiveness or something to stop tax garnishment what should I do

You might try this article: https://www.studentloanplanner.com/student-loan-tax-offset-hardship-refund/

I am $300000 in debt and accumulated the debt while attending medical school. I didn’t make it thru the school but still owe the money is there a way to get this debt forgiven?

Yes, if your loans are federal student loans, you can qualify for forgiveness. Our consultant Rob Bertman wrote an article about this. The first half won’t apply to you since it talks about “should you drop out of medical school” but the second half deals with how to handle your loans when you do: https://www.studentloanplanner.com/what-consider-dropping-out-medical-school/

I have over $55k in loans with Navient that began taking out around 2006-2009 and I became fully disabled in 2017 at the age of 36. Mind you, i was never able to get a job in my field and only had 1 job for 3 months after graduating, at a golf course. I became disabled while in college but didn’t get disability until 2017 because if was unable to get to Dr’s in order to have the proof that i was disabled until 2014. They haven’t given me a discharge because currently my disability is set for renewal every 3 years, so Navient says, but as far as I know I’m listed as Total and Permanent Disability. How can I get them to even accept a copy of my disability letter stating I’m totally disabled? I’ve tried to send it in but every time I contact someone at Nelnet, the company Navient sent my loans to to be serviced by, they tell me there’s no need and to just keep using the Payment Redriven Program(which is no payment) until my disability is permanent. Navient did me the same way before they sent my loans to Nelnet. They’re both basically telling me I’m not fully disabled because I haven’t been on disability long enough, even though the letter says Total, and I can’t get them to even consider receiving the letter. What do I do about this?

Hi Christy, this blog titled Student Loan Forgiveness Disability Discharge: New Automatic Process may be worth a read. If you would like to elevate your concern, read How to Submit an Appeal to the FSA Ombudsman Group After a Dispute with Your Loan Servicer.

I am ready to be rid of my loan with Navient. I feel like I’m being robbed. My initial loan was for 31,000 over 29 yrs ago and now I owe 120,000. Navient indicates I had 2 loans for over 50,000 which I consolidated but that’s not true. I chose forebarence when I was out of work at one point. I’m a public servant and I’ve been paying on time for years however the amount keeps going up. I want to get out of this but don’t know how. Any suggestions?

C.H

If you work for a non-profit, you can qualify for forgiveness. There are a few hoops to jump through, unfortunately. You have to have qualifying loans, work for a qualifying employer, and be on an income-driven repayment plan. For more information, I recommend you connect with one of our consultants to analyze your loans and situation.

Mistake in years it’s been 20 years not 29

I went to Bryant and Stratton in 1994. I worked at hills dept store for 4.10 per hour. I applied for tap and pell. My loans were federal/sallie Mae. In 2006 I received a letter from navient that they took over for sallie Mae and they consolidated my loans now in April 2020 for the first time ever these loans don’t show up on my credit report and are back with the federal NYS education were they were supposed to be from the beginning. Sallie Mae navient and Bryant and Stratton have ruined my credit since then and Bryant and Stratton closed at the location were I attended. They don’t even have a record of me going there. As far as I am concerned they will never see any money

Hello, I have been paying my loans off for 12 years I’m down to my last 5000 is there anyway to get that forgiving?

PSLF requires 120 payments (10 years) so if you’re eligible for that, your balance could be forgiven.

My wife and I consolidated our student loans in the late 90’s with Sallie Mae, I am a disabled veteran and in 2007 I became permanent and totally disabled unemployable and Navient forgave my portion of the principal only, leaving my wife with all the interest for both loans. She is 69, and now only her income can be acknowledged and is less the $700 a month. She is in an Income Driven Repayment Plan (since 2009) paying $0. Is there any way to have this loan forgiven or discharged?

If it’s an income driven repayment plan, the balance should be forgiven after 20 to 25 years of repayment under the current rules of the federal repayment program. You may want to look at booking a consult so we can review your student loans to make sure you’re on the right path.

I’d refer you to a student loan attorney to discuss your legal options.

I have 66,000$ in loans and I lost my job and now I am employed but only at half the wage. Unfortunately I was living high on the hog and accumulated more debt then what my wages can satisfy to make the payments. Can I get a loan forgivness since it seems like the way the democrats are helping people

Hey Bob, here are a few blogs for you to look into: The Ultimate Guide to Income-Driven Repayment (IDR) Plans, Your Best Repayment Strategies Without PSLF, and 10 Ways to Get Out of Student Loan Debt Faster (look at loan forgiveness programs). If you need a customize plan, it helps to book a consult with our team. They will be able to draft a strategy plan that is best for your situation.

I just checked my loans through Navient and am disgusted that they have gone up double of what I actually owed. Now I owe close to $67,000. I work for a non-profit and am looking to get rid of Navient and try to start paying so I can see a light at the end of the tunnel. I believe I have federal and private loans.

Any suggestions?

Hey Becky, you have several options. Here are some blogs to guide you: How to Get Navient Student Loan Forgiveness, Your Best Repayment Strategies Without PSLF, and 10 Ways to Get Out of Student Loan Debt Faster. After identifying which types of loans you have with Navient, it may help to book a consult with our team to determine your best path forward.

I have loans that navient keeps harassing me and my mom about. My mom was a co-signer on the loan. She took responsibility for payments since I have been on disability since I was 18. She agreed to a monthly payment but navient withdrew more money than agreed upon. Navient calls and emails both myself and my mom at least once a day. Are there any legal actions we can take for the harassment and the fact that they will take out more money than was agreed upon? That seems illegal.

Hi Autumn, sorry to learn this is happening to you. Depending on your situation you should see if you qualify for disability discharge. This is also something we’ve heard about Navient, read this blog on top complaints from borrowers. If you’ve exhausted all other options and depending on your situation, it may be consolidating your loans with a new servicer or refinancing them with a private lender. Contact our team if you need a customized plan to determine your best path forward.

Hi there, my friend was swindled by a for-profit college (Art Institute of Las Vegas) which recently was shut down and involved with a settlement with the DoJ for several violations of federal law. She also has lupus, which makes her unable to support herself and she is living with family taking care of their children full-time to try to make ends meet.

I’ve been able to research and find a lot of great information that makes me confidant she is eligible for Borrower Defense and disability discharge for the federal loans, but the private loans are through Navient and for her specific loans (Signature), they say to contact them to find out if she is eligible for total and permanent disability discharge. She is confident she could get a doctor’s note to prove her permanent disability, do you have any information on how Navient handles disability discharges for private loans specifically? I want her to get her life back, she’s working 80+ hours a week right now taking care of 4 kids and I’m worried she’s working herself into an early grave. She doesn’t have money for lawyers and experts, especially with all the medical debt she also can’t pay off. Any help we can get would be so greatly appreciated. Thanks for reading.

Hi David, because these are Navient private student loans, your friend will need to contact Navient. Make sure to also read this blog to make sure your friend can be eligible with one of those programs. Hoping for the best.

I had taken out exclusively sallie mae tuition answer loans through 2006-2008. I had to get a cosigner so I’m sure i qualify as subprime. later I defaulted on the loans. I ended up in bankruptcy court and ended up negotiating the debt down to 50k. They charged off the remaining amounts. Will these loans be cancelled also? I am just so confused.

Hey Anthony, here are 3 Student Loan Forgiveness Updates for February 2022 and Americans Support Additional Student Loan Relief – But Is More On The Way? We will keep you updated as we learn more.

I was supposed to be a co signer on my son’s loan from Sallie Mae I have been paying on this since 2008 if I don’t pay they will garnish my check plus take my taxes which usually is about $100. Just enough to pay my state taxes the total amount owed never goes anywhere now of your blogs say anything about co signers who become responsible for this loan about every two years they go in and raise my payment it started out at $75 a month it is now $265 a month can I get any kind of help on this

Hi Terry, sorry to learn this. Here are a few blogs that may help you: 5 Options If You Can’t Afford Student Loans When They Restart, How to Transfer and Refinance Parent PLUS Loans To a Student, all content on cosigners, 5 Student Loan Resources to Prepare You for Resuming Payments and 107 Ways to Pay Off Student Loans Faster.

I graduated Le Cordon Bleu back in 2008 during the recession. Paid off a big chunk of the loan. Starting loan was about $50,000. Still have about $15,000 left to pay off. It’s been 14 years !! Do you think I’d be eligible to cancel the loan or have student loan forgiveness? I can’t believe I’m still not done paying for it. Please help! What should I do??!

Hi Michael, depending on the type of loans you have there may be options. Unfortunately there are no loan forgiveness options for private student loans. If you have federal student loans, here is a blog on the Ultimate Guide for Student Loan Forgiveness. These programs will be dependent on eligibility so it is important you review each one to see if it’s applicable to you. You may also benefit from reading this blog: 107 Ways to Pay Off Student Loans Faster.

Hello, who can I contact to talk with about my student loans and see if I can apply for this settlement to get my student loans resolved? I would like to fill out an application to see if I qualify. They just changed over to aid advantage. Thanks for your help

Hi Trice, here are 10 key takeaways from the Navient Student Loan Settlement. Essentially, the settlement administrator has set up a website where borrowers can get an overview of the Navient settlement details. In addition, borrowers can get information by contacting their state attorney general offices. Lastly, I think you will enjoy our recent podcast episode on this very important topic.

I’m trying to find our how I can figure out if I’m eligible for the loan discharge through Navient. I had a loan with both Sallie Mae and Navient between 2002 & 2010 with a school that was on the list for misconduct through the Navient list of schools. My loan since then was transferred to Nelnet but I was put on forbearance multiple times during the 2002-2010 period. My school was is Texas. If anyone has any advice or information please please I would appreciate you reaching out.

Hi Monica, here are 10 key takeaways from the Navient Student Loan Settlement. Essentially, the settlement administrator has set up a website where borrowers can get an overview of the Navient settlement details. In addition, borrowers can get information by contacting their state attorney general offices. Lastly, I think you will enjoy our recent podcast episode on this very important topic.

I have 61k worth of parent plus loans. I am a resident of Pa. Are my loans eligible for the 2022 loan forgiveness?

Hi Becky, here are the 5 Best Ways to Pay Off Parent Plus Loans.

My mother took out a federal parent plus loan with SallieMae in 2005 for my time at Westwood College in CA. The loans were on forbearance up until 2019 when I refinanced them under my name to pay it off. Is there anything I could qualify for now to address the remaining balance?

Hi Angelica, unfortunately there are no student loan forgiveness options for private student loans. If you refinance the Parent PLUS Loans, then they are now private student loans. Here are 4 alternatives to student loan forgiveness that may be of interest.