Income-driven repayment is a huge benefit of the federal student loan system. Unfortunately, it’s confusing to know which plan to choose. It can be even more confusing if you have drastic income changes during your career that can impact how your income-based repayment is calculated.

When you graduate, your federal loans are put on the 10-year Standard Repayment Plan. This plan knocks out your loans in the shortest possible time. The problem is, if you’ve borrowed anything larger than about a dollar, your monthly payment amount tends to be very high.

So, starting in the early 1990s, the Department of Education introduced income-driven repayment (IDR) plans; the first of which was the Income-Contingent Repayment or ICR plan, which wasn’t the greatest. Today, there are four IDR plans to choose from, including ICR, Pay As You Earn (PAYE), Income-Based Repayment (IBR) and Saving on a Valuable Education (SAVE) — which used to be called REPAYE.

President Biden's new SAVE plan has far more generous repayment terms and student loan forgiveness opportunities. However, there are some cases where other IDR plans might come into play.

We’ll walk you through some real examples of how to choose the right student loan repayment plan. You’ll also learn how your payment will change as your income changes using Student Loan Planner’s free repayment calculator. It’s the best around. We’ll start with some basics you need to know before you input numbers into the calculator.

Income-based repayment calculations depend on your income

Some student loan borrowers think of “income” as their total salary, while some borrowers think of “income” as what hits their bank account. In the world of student loans, there’s only one definition of income that matters — your adjusted gross income or AGI.

This is a specific number on your tax return. In fact, if you dig out your most recent tax return, it’s line 11 on your Form 1040.

The AGI calculation is most commonly your gross (or total) salary minus:

- Pre-tax 401(k), 403(b), or 457 retirement savings (your portion, not your employer match)

- Pre-tax or traditional IRA contributions (Roth IRA contributions don’t count)

- Health Savings Account

IDR payment calculation formula: How it works

How are income-based repayment amounts calculated? It depends on which IDR plan you choose, but there’s a general income-based repayment formula calculation you can start with.

1. Start with your AGI. Then, subtract the federal poverty guideline level for your family size based on your chosen IDR plan. The new SAVE plan allows you to deduct 225% versus only 150% with PAYE or IBR. This is your discretionary income in the student loan world.

AGI – (150% x Poverty Level) = your discretionary income on PAYE or IBR

AGI – (225% x Poverty Level) = your discretionary income on SAVE

2. Once you know your discretionary income, multiply by either 10% for SAVE or PAYE, or 15% for IBR. Undergrad only borrowers can multiply by 5% if on SAVE.

[AGI – (150% x Poverty Level)] x 10% = annual payment for PAYE and New IBR

[AGI – (150% x Poverty Level)] x 15% = annual payment for Old IBR plan

[AGI – (225% x Poverty Level)] x (number between 5% and 10%) = annual payment for SAVE plan

The multiplier for SAVE depends on how much undergrad debt you have relative to grad debt.

3. Divide by 12 for monthly payments.

Bonus, our free student loan calculator does all of this complicated math for you. I know some readers like to nerd out as we do, but it’s all done by the calculator, so all you really need to know is your income.

Get Started With Our New IDR Calculator

Scenarios of how income-driven plan payments change with income

Now that we know how income is defined, and how income-based repayment is calculated, let's look at some examples.

Scenario 1 – New to calculating your IBR payments

New to income-driven repayment? This scenario is for you.

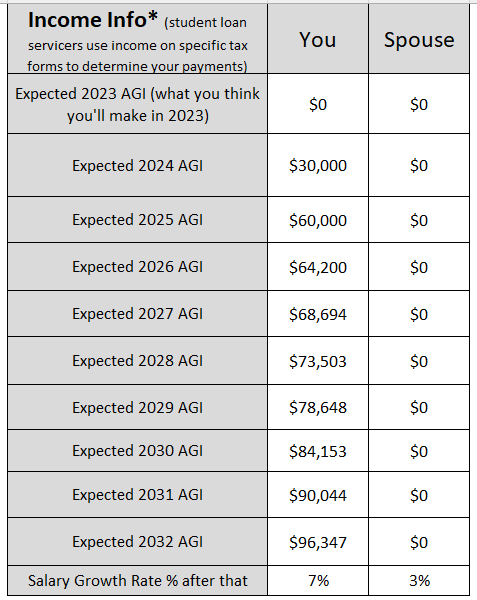

Let’s say you’re leaving your MBA with $125,000 of federal student loan debt and are starting a job at the lower end of the spectrum to “learn the ropes.” You anticipate making about $60,000 per year. But you expect your salary to drastically increase quickly — about 7% per year — for the next 10 years.

You're currently single for the sake of simplicity (but we’ll look at a marriage example later). Here’s how your income grows, and your options for student loan payments.

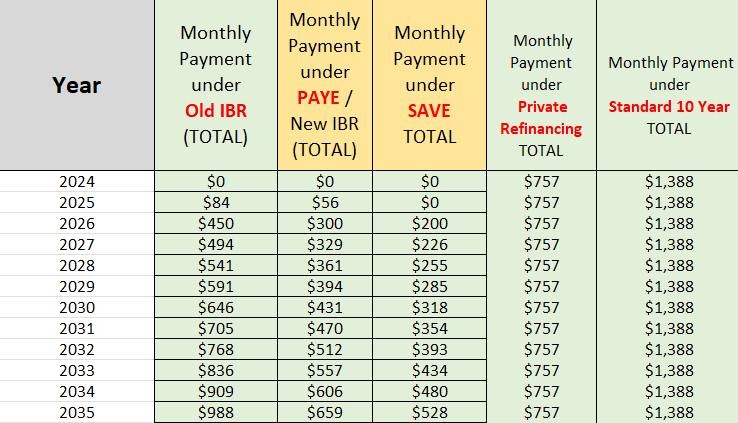

When you graduate, you’ll automatically be placed on the standard 10-year plan, resulting in a monthly student loan payment of $1,388 per month. That’s painful for a new professional starting at a $60,000 salary.

What about refinancing? Using a 4% interest rate over a 20-year repayment term, you could pay $757 per month by refinancing. To qualify for a low refinance interest rate, you’ll need good credit or a cosigner.

Now, let's look at IDR options. As you see with increasing income, whether that increase is 1% per year or 7% per year, your monthly IDR payment gradually increases.

The most favorable income-based options are SAVE and PAYE as both use 10% of discretionary income for graduate borrowers. However, SAVE and PAYE have some distinct differences. For example, SAVE provides a higher poverty line deduction, resulting in lower monthly payments. But PAYE only requires 20 years of repayment to reach forgiveness versus 25 years with SAVE (applicable to graduate loans), which might result in paying less overall.

Therefore, the analysis for graduate borrowers will be whether to pay for 20 years on PAYE / New IBR or 25 years on SAVE.

Weighing PAYE vs. SAVE

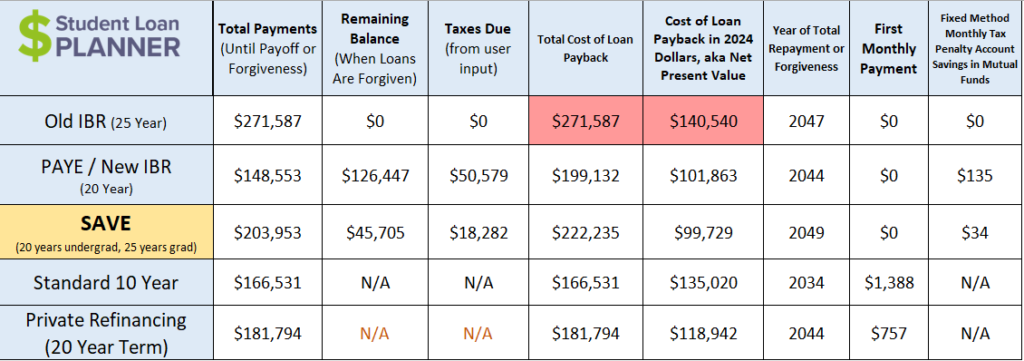

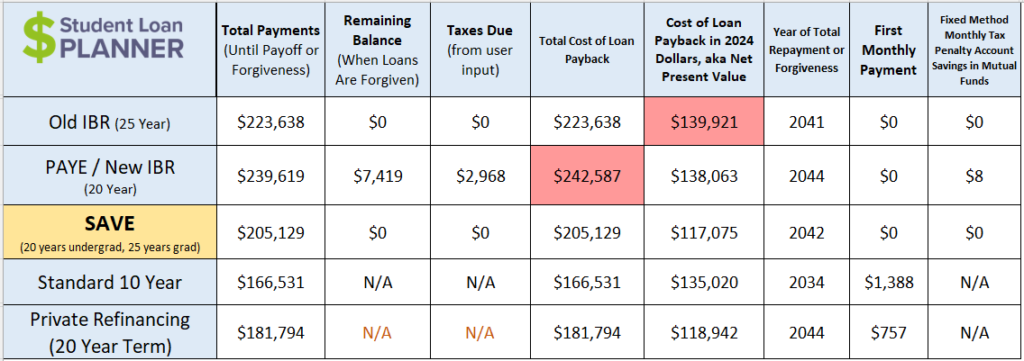

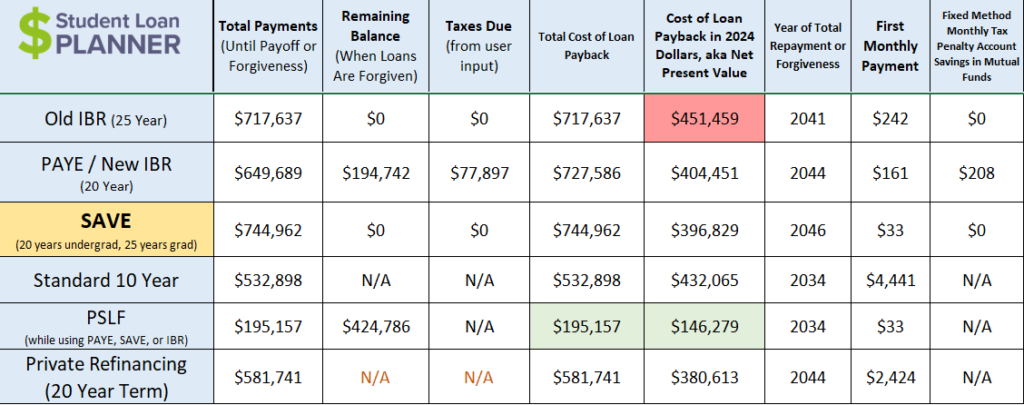

In terms of the total cost of loan payback, the standard 10-year plan is the best option, but remember the monthly payment? It’s $1,388 per month. Yikes. Instead, we'll look at lower payments with PAYE versus SAVE considering both are much more manageable than $1,388.

Under the PAYE scenario, you’ll eventually spend $148,553 paying your student loans back over 20 years. You’ll need to save about $135 per month into a taxable brokerage account to save for the projected tax bomb of $50,579.

In comparison, under the SAVE scenario, you'll make $203,953 of student loan payments over the course of 25 years, with a projected tax bomb of $18,282. In which case, you'll only need to save about $35 per month via a taxable brokerage account.

If we look at the total cost of loan payback for IDR plans, PAYE is the winner — primarily because of the shorter forgiveness timeline. But if we look at today’s dollars, or net present value (NPV), SAVE is the winner.

That’s why paying back loans from your MBA can be complicated.

Understanding you might pay between $165,000 to $272,000 for $125,000 of student loan debt, you should consider aggressively paying these back to avoid as much interest as possible. But there’s an argument for SAVE, PAYE and private refinancing depending on your monthly budget and other financial goals.

Scenario 2 – Change in income-based repayment when married

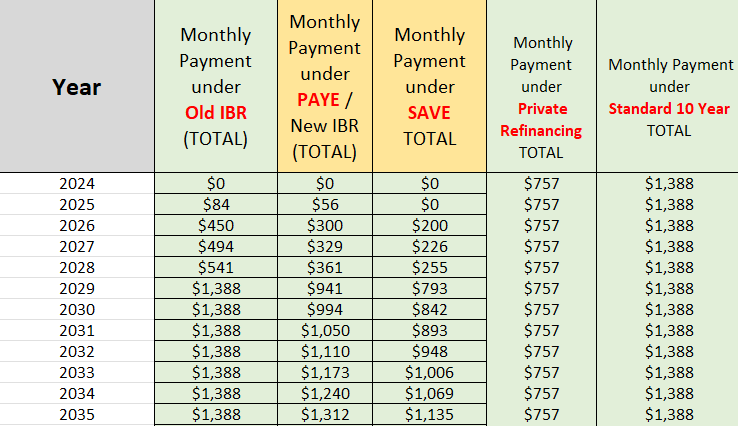

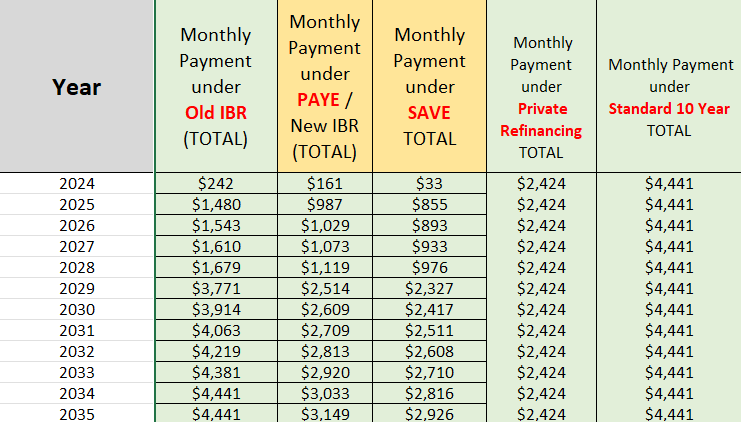

In this scenario, our recent MBA graduate marries a nurse who makes $75,000 per year in 2028 and receives a standard 3% raise going forward. They decide to file their taxes jointly. This changes our MBA borrower’s scenario significantly.

Note that the standard 10-year and private student loan refinancing outcomes stay the same, but all three income-driven repayment options change, drastically. For example, in 2029 under PAYE, our MBA borrower’s payment jumps from $361 to $941 by adding their spouse’s income.

PAYE is now the worst-case scenario. When looking at NPV, aka the cost in today's dollars, you'd be better off going with the SAVE plan. If you prefer to aggressively pay them off, refinancing to a lower interest rate is also a solid option.

That said, this scenario is a great case for filing your taxes separately. If you file separately, you’re allowed to exclude your spouse’s income from your loan payment calculation. It’s not a fit for everyone, and you can lose out on some benefits like:

- The student loan interest deduction of $2,500 — this might not be applicable to you, however, if you make a high enough income.

- More advantageous tax brackets, unless you’re in a community property state.

- Child care tax credit.

- Earned income tax credit.

- Exclusion or credit for adoption expenses.

- Ability to contribute to a Roth IRA, though you can still utilize the back-door Roth conversion method.

- Ability to deduct rental property losses.

- Ability to take the standard deduction if your spouse itemizes, or vice versa.

Scenario 3 – How IBR changes with a drastic increase in income

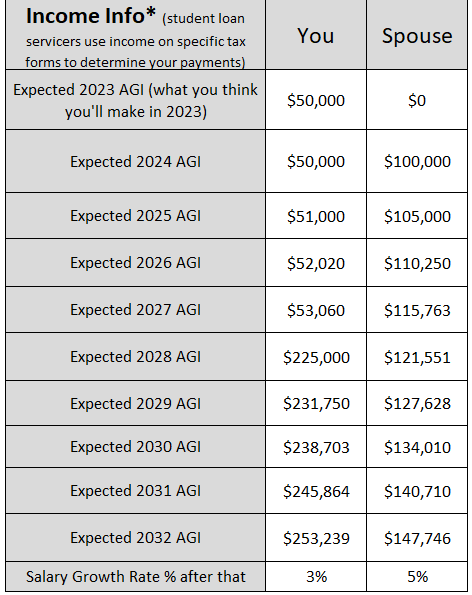

In our final scenario, let’s shift gears and look at how your income-based repayment is calculated with a drastic increase in income.

A doctor is finishing their residency or fellowship, where their annual income will go from about $50,000 to $225,000 per year. They’re working at a nonprofit hospital and got married in 2024. This borrower plans to have kids starting in 2029.

Here’s their income and repayment outlook:

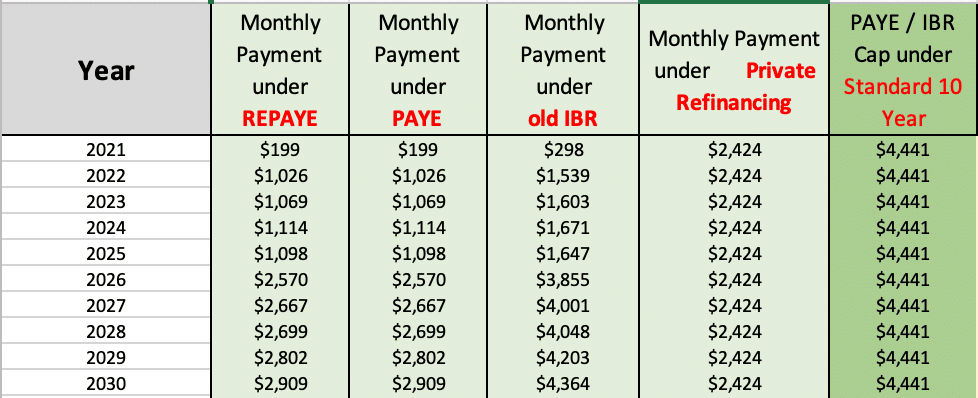

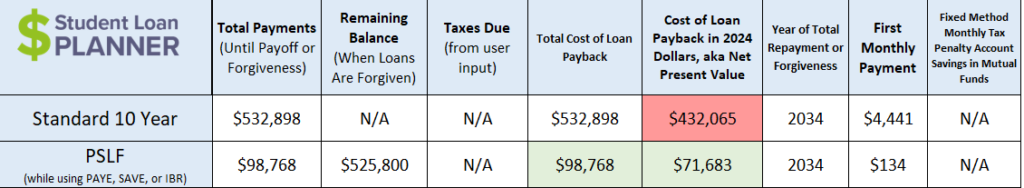

As you can see, because we’re talking about income-driven repayment plans, the higher the income, the higher the payment. The standard 10-year plan would require a $4,441 monthly payment based on their $400,000 student loan balance.

Private refinancing is better at about $2,424, but IDR eases some of that burden, especially if this particular physician is working for a nonprofit hospital.

Even if this couple decides to keep their tax situation simple and file jointly, our physician still comes out on top because of Public Service Loan Forgiveness (PSLF).

Specifically, working for a nonprofit hospital through residency, fellowship, and for a few years out of fellowship can save the physician over $300,000 compared to their next best option — the standard 10-year repayment plan with that dreaded $4,000+ payment.

Shockingly, filing taxes separately from their spouse can save another $100,000.

Final considerations when calculating your IDR payment after an income change

To calculate your income-driven repayment amount, you need to know:

- Your AGI. This is found directly on your most recent tax return.

- The federal poverty line for your family size.

Things to consider:

- Your eligibility for each repayment plan.

- Your retirement savings options (Hint: It can’t hurt to save more.)

- How to file your taxes (joint versus separately).

- Which state you live in. Community property states have different rules regarding taxes.

- How complicated you want your student loan plan to be.

Does this feel completely overwhelming? It’s really complicated, which is why we’re here for you. Schedule a consultation with us and we’ll review your individual circumstances. Having a customized student loan plan can take a big weight off your shoulders.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).