Opening a physical therapy practice isn’t the right career choice for all physical therapists. But if you have an entrepreneurial spirit and are willing to learn, you can turn your dream into a reality — even if you have student loan debt hanging over your head.

Why you should consider opening a physical therapy practice

Many physical therapists choose to open their own practice for a variety of reasons. You get to be your own boss and have more control over patient interactions. You also have the potential to make more money and have more flexibility in calculating your adjusted gross income (AGI). This can come in handy during tax season and other financial situations, like repaying your student loans.

Salary range for physical therapists

According to the Bureau of Labor Statistics (BLS), income for physical therapists ranges. The bottom 10% made roughly $60,000 annually, while top earners brought in around $120,000.

| Percentile | 10% | 25% | 50% | 75% | 90% |

|---|---|---|---|---|---|

| Hourly wage | $29.03 | $34.94 | $42.27 | $49.29 | $59.30 |

| Annual wage | $60,390 | $72,680 | $87,930 | $102,530 | $123,350 |

But opening a physical therapy practice can unlock the door to achieving a higher income and growing your wealth over time.

How much does it cost to open a private physical therapy practice?

The cost of opening your own practice varies based on your location and specifics related to your office. Some common expenses to consider include:

Startup costs

State and local permits can range from a couple of hundred dollars to a few thousand. You’ll also need to look into professional liability insurance and other types of business protections.

Equipment costs

Your equipment needs will depend on the type of services you want to provide. A simple oak treatment table, for example, could cost less than $1,000, whereas a two- or three-section treatment table could cost over $2,000. You’ll also need ultrasound muscle stimulators, heart rate monitors, and other fitness equipment like treadmills for treatment. Keep in mind that you can lower costs by purchasing used or budget-friendly equipment.

Fixed costs

A big cost is going to come from your space itself, whether you rent or buy. Because of this financial impact, you should evaluate how much space you really need. Maybe you can forgo the cost of a 4,000-square-foot space and choose to work with a 1,000-square-foot space if it means you’ll pay a quarter of the cost. Or maybe you can explore subleasing a space from another health professional to save on costs. Keep in mind that you may also need to invest in billing services and medical software (e.g., an electronic medical record and practice management system).

Variable costs

Be prepared for monthly expenses like utilities. You’ll also need to budget for supplies and marketing efforts.

Labor costs

You’ll likely have at least a couple of employees to help run your business. Factor in employee wages and benefits when determining your overall costs.

Related: What to Know About Kiddie Tax and Hiring Your Kids as Employees

This isn’t an exhaustive list of expenses. Your overall cost will depend heavily on your individual goals. You may be able to start your practice with relatively low costs if you’re starting out part-time and functioning as a mobile service. Or, you may need to have significant savings or be willing to secure a loan in order to afford a high-end brick-and-mortar location.

Other PT business considerations

The costs of opening a physical therapy practice can quickly add up, so it’s important you go in with a clear business plan.

Start by thoroughly answering the following questions:

- Can I run a business on my own? Consider whether you want to run your practice with a partner or go solo. A partnership can help fill in missing gaps in your business plan — like funding sources, professional relationships, and knowledge and experience. But partnerships also mean you’ll have multiple cooks in the kitchen, which may lead to differences of opinion and less control overall.

- What type of practice do I want? Just like with any other type of business, you should figure out your niche within physical therapy. For example, you could focus on pediatrics, women’s health or sports physical therapy. By choosing a niche, you can become the area expert and tailor your marketing efforts to your target audience.

- Should I be a cash-based or insurance-based business? Many physical therapists choose to open a cash-based practice due to a decline in insurance reimbursement rates.

- How can I get financing? You may need to use a Small Business Administration loan if you aren’t able to get a conventional loan from a financial institution.

If you don’t have answers just yet, reach out to your colleagues who have gone the same route. Ask about their experiences and recommendations so you can avoid common mishaps.

Is financial planning with SLP Wealth right for you?

Looking for student loan aware financial planning custom tailored for professionals like you? Check out the discounts below for becoming a client of SLP Wealth (our SEC Registered Investment Advisory firm).

How a physical therapy practice can grow your wealth

A lot of borrowers assume they can’t move forward with opening a private physical therapy practice because they have too much PT student loan debt. But with the right strategy, you can realize your dream of being your own boss and likely lower your student loan payments at the same time.

As a general financial rule, you want to take steps to minimize your taxable income. But as a regular wage-earning employee, you have limited options for reducing your taxable income.

For example, you might not have great retirement options through your employer. If you’re lucky, your employer will offer a 401(k) plan that allows you to make up to $19,500 in contributions each year. But if they don’t, you may be stuck with setting up a Traditional IRA that only has a $6,000 annual limit. This difference can significantly impact your strategies for saving for retirement and reducing your taxable income.

By owning a physical therapy practice, you can choose which retirement plan you want for you and your staff.

Private PT practice example

Let’s look at an example to show why you might want to own a private practice over working for an established clinic.

Pretend your employer pays you $70,000 each year, but the gig doesn’t include a retirement plan. So, you max out your Traditional IRA contributions at $6,000. This would bring your taxable income down to $64,000.

But your colleague Christine owns her own physical therapy practice. She makes about $90,000 after paying her staff. She chose to set up a 401(k) for the practice with a 5% match. That means she’ll contribute $4,500 as the employer. She then makes an additional $19,500 contribution to her account as the employee. This gives her a total of $24,000 in retirement contributions.

Christine can also deduct various business expenses, like rent, utilities, insurance and depreciation of equipment. Let’s say that gives her a deduction of roughly $15,000. Her net income then becomes $51,000.

So, Christine would be able to pay less in taxes by shielding more of her income, even though she made $20,000 more than you.

How a private practice could impact your student loan debt

Keeping with the same example, let’s also say you and Christine both have $200,000 in student loan debt.

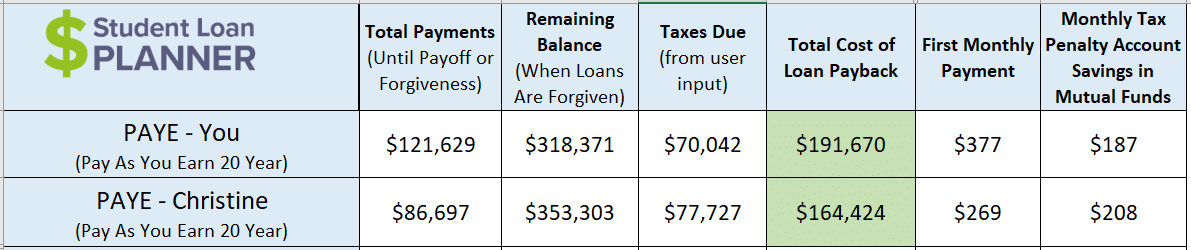

Using the Student Loan Calculator, you’d pay $377 a month under the Pay As You Earn (PAYE) plan, and about $190,000 total once you account for all of your payments and your tax bomb after loan forgiveness.

Christine, however, would pay $269 a month and about $165,000 total after forgiveness.

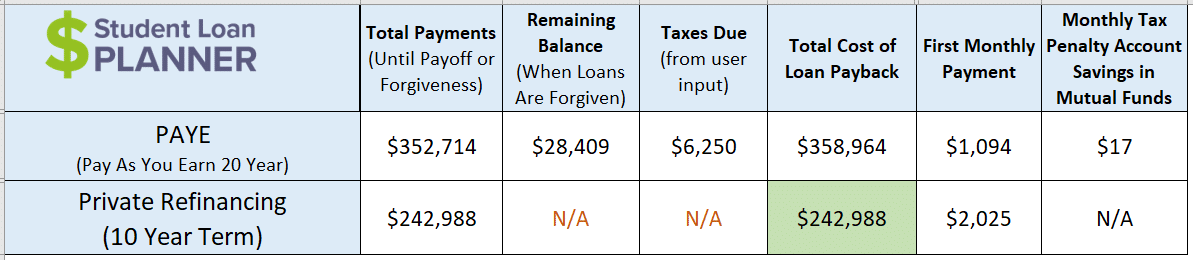

Although PAYE and other income-driven repayment (IDR) plans can reduce your monthly payment, refinancing your physical therapy student loans may make sense if you run a successful practice.

For example, once your AGI reaches around $150,000 annually, your PAYE payment would be much higher than our previous examples. This calculation assumes a 4%, 10-year fixed rate for refinancing.

Plus, you’d pay significantly more over the life of your loan. And, you wouldn’t benefit from a hefty forgiven balance at the end of your repayment period.

Keep in mind that if you work in the public sector or practice in a high-need area, you may be able to take advantage of various loan forgiveness programs.

With so many repayment and forgiveness paths, it’s easy to get tripped up on the details and forgo pursuing your dreams out of fear. Let our team help you figure out your best route to financial success by creating a custom plan for tackling your physical therapy student debt.