Clerkships can be a valuable way for new law graduates to gain experience and learn a lot in a short amount of time. Unfortunately, law clerks tend to have six figures of student debt from law school loans. The average law school debt is supposedly over $200,000. Unfortunately, our average JD client owes $228,358.

Our data is certainly biased upwards, as borrowers with higher than average debt amounts tend to be the ones who reach out for help. That said, new lawyers leaving law school with debt that’s more than $200,000 is actually quite common now.

If that’s you, do you eschew your dreams of clerkship with a state or federal judge just so you can hurry up and start making more money? Law clerks can save thousands on their student loans. Here’s why you should feel confident in taking that clerkship position even with six-figure law school loans.

Do Law Firms Pay Off Student Loans?

Say your ultimate goal is to use a clerkship as a way of getting an extra credential to stand out from the pack when you’re trying to get a Big Law job. In that case, let’s assume you currently have $200,000 of law school debt.

The median wage for a judicial law clerk is $66,310 in May 2022, according to the BLS. So, let's assume you earn $60,000 per year for a two-year commitment.

At the end of this clerkship, you know you’re going to have a job waiting for you in New York. Let’s assume you’ll get a $50,000 clerkship bonus and a $220,000 salary in your first year (you got the third year associate bump). With your $220,000 salary, you know you want to refinance, perhaps with a lender like First Republic Bank.

However, during your clerkship, you think that forbearance is your best option. After all, how could you afford payments on your loans at such a meager salary?

Using REPAYE as a Law Clerk If Your Plan is to Refinance

The Revised Pay As You Earn program (REPAYE) pays 50% of the interest that you are not currently paying with your calculated payment. In other words, if you have $200,000 of debt at a 7% rate, you would incur $14,000 of interest charges. Pretend your annual payment on REPAYE is $4,000 with $10,000 of interest that would accrue on any other income-driven repayment plan.

However, with the REPAYE plan only, the government would pay 50% of that remaining $10,000 for you. Instead of $10,000 of interest accruing, only $5,000 of interest would accrue. You cut your actual interest expense from $14,000 to $9,000. Furthermore, since you paid $4,000, you would only accrue $5,000 of interest expense instead of the $14,000 someone in forbearance would accrue.

- REPAYE is a way to gain interest subsidies as a law clerk that you don’t have to pay back later, even if you take a job in Big Law

- REPAYE counts towards PSLF and the 20-25 year version of loan forgiveness in the private sector as well

- You might want to use a different repayment plan if you’re married depending on your unique tax situation

Hence, most law clerks can save thousands on student loans, if they tackle student loan debt immediately following graduation from law school. They could use their $0 incomes at that time to secure $0 required monthly payments. This would ensure an interest subsidy in the first year equal to 50% of their interest.

Even though 7% interest looks terrible, you could cut that temporarily with REPAYE to as little as 3.5%.

What If You Want to Do Public Interest Law?

Here’s exciting news. Let’s say the work you do with the judge you’re working for is so exciting that you decide you want a career in the public sector. The interest subsidies won’t matter all that much to you because you’ll want to pursue Public Service Loan Forgiveness (PSLF).

This program allows you to pay based on your income for 10 years on an income-driven repayment plan (REPAYE is one that qualifies), and the government forgives your debt tax-free at the end of 10 years.

Imagine that you do a clerkship undecided about your future. You think you might like to try for a Big Law job, but you also think working in the public sector is not out of the question.

Hence, if you utilize the REPAYE program while working as a law clerk, you cover both of your options. If you end up doing Big Law, you owe less money to pay back through refinancing. If you decide to do public interest law, you already have a year or two of credit towards the 10 years needed for the PSLF program.

When Should You Use PAYE or IBR As a Law Clerk?

The REPAYE program is very good if you’re single, unsure of your future path, and you want to keep the interest no your debt as low as possible.

However, the Pay As You Earn (PAYE) and Income Based Repayment (IBR) programs are options too. Generally, the only reason someone would use IBR is if they are ineligible for the PAYE plan. That’s because PAYE asks for 10% of your income and IBR asks for 15%. Paying less is the right thing to do if you want to get the most out of forgiveness.

Why would IBR be better than REPAYE since 15% is greater than REPAYE’s 10% you ask? It’s because IBR allows you to exclude your spouse’s income if you file taxes separately. Sometimes 15% of just your income is better than 10% of both of your incomes. This is particularly true in the case of PSLF.

PAYE is 10% of your income, and you had to have no debt prior to October 2007 to qualify. In some complex situations, PAYE can allow you to pay less than REPAYE if you’re filing taxes separately from your spouse. This could allow you to pay less and get more forgiven.

What Should You Do with Your Loans if You Work in a Small or Mid-Sized Private Practice After a Law Clerkship?

If you don’t earn enough money to comfortably refinance your student loans and you don’t qualify for PSLF, then going for forgiveness over 20-25 years might make sense. The average time to pay off law school debt with the PAYE program is 20 years and the REPAYE program is 25 years.

If you will earn $70,000 per year after your clerkship, and you owe $200,000 of law school student debt, then forgiveness is likely your best path.

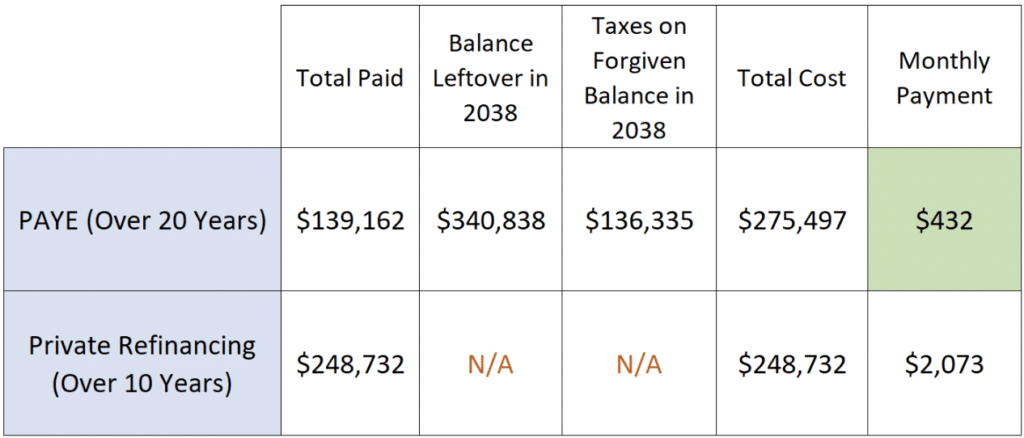

Here’s how this cost looks over time:

You’ll notice that while the absolute cost is less with refinancing if you inspect the total cost, you’ll notice that PAYE is over 20 years while refinancing at a 4.5% is over 10 years. Because of inflation, that makes PAYE by far the better option.

You can see this with the monthly cost of $432 a month. The private practice lawyer, in this case, would just need to prepare for the $136,000 tax penalty due in 2038 (20 years from present).

By starting payments while clerking for a state judge, for example, the lawyer in this example would have paid on a very small salary now while saving a year or two of much larger payments later.

Focus on Learning in Your Clerkship, But Don’t Ignore Your Law School Loans

A popular way of dealing with law school debt is to do nothing, but clerks can save thousands on crippling student loans by taking action, let that be you.

You should consolidate your debt with the government as soon as you graduate if you haven’t already started making payments (you don’t want to wipe out credit towards student loan forgiveness that you already have).

This consolidation will allow you to get close to $0 a month payments and either pick up interest subsidies, gain credit towards loan forgiveness, or both.

If you’re already done with your clerkship, we can help you make a plan and figure out your law school debt too. The most important thing is to pay just enough attention to it so law clerks can save thousands on student loans.

Where are you with paying down your law school student loans?

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).