Brian is a physician assistant working in a private practice after paying for PA school with student loans. We recently had a consult and determined his situation would be great for a physician assistant student loan case study.

He started paying back his loans 6 years ago on IBR but when he found out about REPAYE (revised pay as you earn) back in 2016, he switched over to lower his monthly payments.

But now it may make sense to change again.

Brian was engaged recently to Abby and they’re planning to get married next year. Abby doesn’t have any student loans but he knew that her income would increase his monthly payments on REPAYE.

After following Student Loan Planner® for a while, he decided to reach out and book a consult after reading our article on how confusing it can be for PAs to pay back their loans so that he could get clarity on what loan repayment looks like post-wedding. He also wants to make sure he and his fiancee can get on the same page before getting married.

By the time we finished the consult, they knew the road in front of them, what it would take to be debt free, and they were on the same page regarding how to go about it.

Oh yeah, and in the process, we uncovered tens of thousands in savings paying back his loans.

We detail how we made it happen in this physician assistant student loan case study below.

Brian’s Physician Assistant Student Loan Profile

Brian is a PA working in a private practice. He owes $195,000 on his direct federal student loans with an average interest rate of 6.55 %. He had been on the IBR plan (25 years of payments at 15% of discretionary income) from 2012-2016 and REPAYE (25 years of payments at 10% of discretionary income) for 2 years.

He first borrowed for undergrad in 2006 so he is not eligible for PAYE (Pay As You Earn).

Brian earns $110,000 with projected raises of 3% each year. His future wife Abby has no student loans and earns $70,000 with 3% projected raises as well.

Selecting REPAYE (Revised Pay as You Earn) for PA Loans

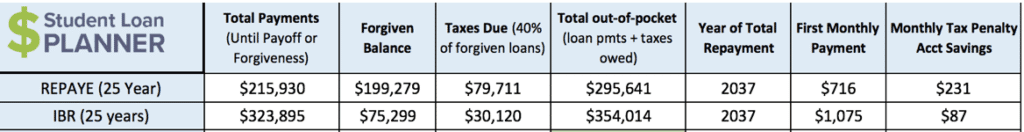

REPAYE is a common option for loan repayment for physician assistants. Let’s take a look at Brian’s decision to pay back his student loans on REPAYE (pre-engagement):

REPAYE looked like a good strategy especially compared to IBR. Between payments over the next 19 years and the tax bomb, it is projected to cost Brian 5,641 paying back his loans on REPAYE (about $60,000 less than if he had stayed on IBR).

Let’s see how the numbers change taking his fiancee’s income into the picture:

Now this is interesting.

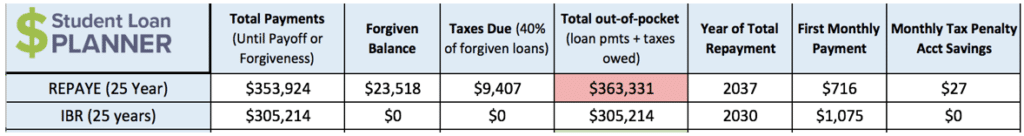

Normally REPAYE is a less expensive way to pay back student loans compared to IBR, but not in this case. Taking Abby’s future income into consideration, Brian’s path on REPAYE ends up becoming $58,000 more expensive than IBR. We also ran the IBR numbers if they were to file taxes separately. IBR filing jointly (shown above) still projected to be cheaper.

Why is this the case?

It’s because his IBR payments would jump up significantly too if they filed jointly. In fact, they would jump up so much that he’d pay off his loans in 12 years on IBR vs 19 on REPAYE. That 7-year difference in payments is why IBR is cheaper.

You might be thinking, “Great! I’m student debt free 7 years sooner and I save almost $60k!”

Here’s the problem with that.

Choose One Extreme or Another – Aggressive vs Passive

We’ve done more than 1,000 consults and advised on than $300,000,000+ in student loans. What we’ve found is that people save the most money when they choose one of these two extremes:

- Super aggressive: Get the lowest interest rate you can and pay off your student loans as quickly as possible. (10 years or less but ideally 5 years).

- Super passive: Choose an income-driven repayment plan with the lowest monthly payment and do everything to lower payments even more and max the number of loans that would be forgiven.

Option 1 works for people whose income is high enough that they can afford to repay their loans quickly. It saves them a ton of interest so they can keep more money in their pocket and be debt free much sooner.

Option 2 works for people who either don’t have the income to pay back their loans aggressively or could be eligible for PSLF (Public Service Loan Forgiveness). I understood how tax-free loan student loan forgiveness for physician assistants on PSLF could save a lot of money, but it took awhile for my financial brain to fully absorb the idea that owing a tax bomb in 20 or 25 years can actually save money. I won’t go into details here, but making extra loan payments on this path is actually a waste of money.

So if Brian were to switch to IBR and pay off his physician assistant student loans in 12 years at 6.55%, that is neither super aggressive or super passive. In the end, he’d end up paying back a high-interest loan.

The next step would be to explore refinancing to get a lower interest rate, but before doing that we had to ask him a very important question.

The Important Question – PSLF Eligibility

“Brian, is there any chance that you’d want to work for a non-profit or government employer?”

Seems benign, but it is critically important before considering refinancing. Why?

Once someone refinances their physician assistant loan debt with a private company, they leave the federal program. That means loan forgiveness and other federal program perks are gone for good including the incredible savings that PSLF could offer.

Brian: “Not a chance! I love the practice I work for and the hospital jobs around here pay a lot less.”

Me: “Ok, let’s compare refinancing.”

(On a side note, I’ve been seeing some PAs mention that they’d like to go part-time once they have kids. That means that their payments might not count toward PSLF, so that’s another question to think about.)

Explore Private Refinancing

With marriage on the table, we’ve explored staying on REPAYE or switching to IBR. Now that we are confident PSLF is not on the table, it’s time to compare those options to private refinancing.

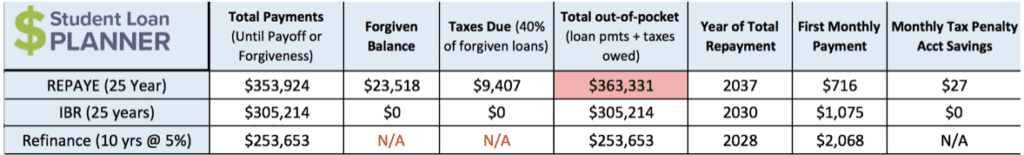

Refinancing would be the aggressive approach so we’re looking at a 10-year repayment term.

Rates at the time were around 5% plus or minus depending on credit score and other factors. That’s much better than his 6.55%.

Bingo!

Remember when IBR projected to save Brian $58,000 and 7 years paying off his loans compared to REPAYE? Seemed good at the time right?

Well, refinancing would save him $110,000 and 9 years compared to REPAYE. That’s almost 2x the savings and gets him debt free 2 years earlier vs IBR.

Comparing IBR to refinancing also shows the power of picking the super aggressive approach for his situation.

IBR is just like paying off $195,000 in loans at 6.55% in 12 years. It’s not aggressive enough and he’d end up spending $305,214 and be student debt free in 2030.

Refinancing $195,000 at 5% for 10 years would cost Brian a total of $253,653 between principal and interest and he’d be student debt free in 2028.

Even just being 2 years more aggressive and securing a lower interest rate would save him $52,000 paying back his loans. The savings is all interest. That’s almost real money 🙂

Brian’s Student Loan Repayment Summary

Brian and Abby were thrilled to have this all figured out in just an hour on the phone rather than spending days researching and never having the confidence that they were on the best plan with the most savings.

He was able to secure that 5% rate using these student loan refinancing offers. Plus, he qualified for a nice cash back bonus too. Icing on the cake.

In the end, if Brian decided to stay on REPAYE instead of looking at his alternatives with a consult, he would have needlessly spent $110,000 more paying back his loans and delayed his student debt freedom by 9 years.

How to Pay off Physician Assistant Student Loans

By working with someone who handles student loans every day all day, Brian was able to find the cheapest way to pay back his loans.

More importantly, Brian’s marriage will be starting off on the right foot financially. Student loans can be a big burden to carry into a relationship. Even though his fiancee didn’t have student loans, she was able to be on the call and ask questions, understand the path for Brian to become student debt free and she was fully on board with the plan.

If you’re financing your PA education and struggling to figure out what your optimal student loan repayment strategy could be, reach out to me.

As shown in this physician assistant student loan case study, physician assistants often struggle with the best way to pay back their student loans because of their income trajectory and how much they owe. How great would it feel to know that you’ve looked at all the options and know you’re on the right path for your specific situation?

I’d love to help you find significant savings paying back your loans and give you the action steps to make it happen in just one hour. Plus I’ll be there to help along the way with the 6 months of email support included in the consult.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).