Based in Southern California and want to be an optometrist? One school you might be considering is the Southern California College of Optometry at Marshall B. Ketchum University (MBKU) in Fullerton, California. The school is an independent, private institution. Like many other private institutions, the costs associated with attending this school are high. Read on to learn more about Southern California College of Optometry tuition and if it’s worth your investment.

Southern California College of Optometry tuition

The Southern California College of Optometry isn’t exactly cheap. According to its projected budget for the 2019-20 academic year, tuition costs $44,600 each year. Upon adding living expenses, books, transportation and so forth, the school projects that students will pay a total of $73,366 to attend the school for the first two years; $80,161 for year three; and $80,822 for the final year.

So based on tuition alone, the costs you’re looking at are:

$44,600 x 4 years = $178,400

Based on the projected budget including books, living costs, etc., you’re looking at:

Year 1: $73,366

Year 2: $73,366

Year 3: $80,161

Year 4: $80,822

Total: $307,715

The cost could nearly double when you look at the big picture and not just tuition. If you live with family or find affordable rent (though this has become increasingly difficult in Southern California), your expenses may be lower. Even so, you’re most likely looking at more than six figures of debt.

The Southern California College of Optometry has 100 students enrolled for 2019. Over the past five years, 90% to 96% of students graduated on time.

Graduating with student loan debt

If you attend the Southern California College of Optometry at Marshall B. Ketchum University, it’s likely you’ll need to take out student loans.

According to a report from the Association of Schools and Colleges of Optometry, the average indebtedness of graduates from U.S. schools and colleges of optometry as of 2019-20 was $186,772.

From the same report, the average indebtedness for graduates with debt from Southern California College of Optometry and Marshall B. Ketchum as of 2016-17 was $171,704. A large number of graduates — a full 80% — graduate with student loan debt. As you can see, the Southern California College of Optometry cost isn’t exactly cheap.

The average indebtedness is lower from this school relative to the general average of optometry graduates. But only slightly so. And averages can be skewed when considering borrowers who take out a small amount. At Student Loan Planner®, we’ve worked with many optometrists who have more than $200k in student loan debt.

When it comes to taking out student loans, borrowers can choose from federal student loans or private student loans. Federal student loans are the preferred option, as they come with benefits and protections, such as student loan forgiveness, deferment and forbearance.

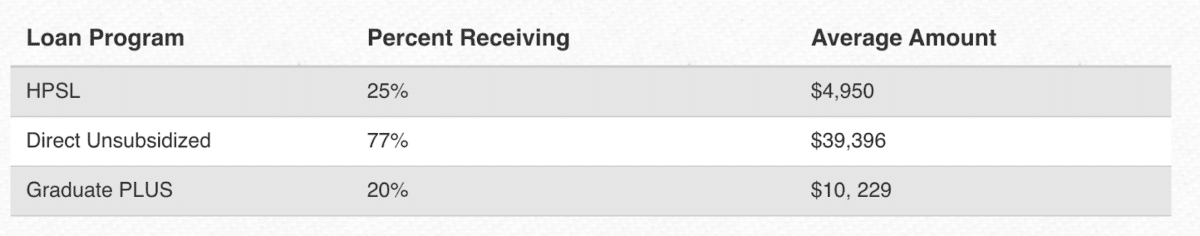

According to data from Marshall B. Ketchum University, the types of loans being used by students include:

- Health Professions Student Loans

- Direct Unsubsidized Loans

- Graduate PLUS Loans

The percentage of students receiving aid as well as the average amount of aid are shown below:

Source: Marshall B. Ketchum University

We don’t have data on private student loans, but if federal loans don’t cover all the costs, students may turn to private loans to cover the gap. And in some instances, private loans may offer more competitive rates than PLUS Loans, which historically have high interest rates.

If you’re interested in attending this school, you might be wondering if it’s worth the investment. Taking out more than six figures of debt can have a great impact on your financial future.

According to data from the Bureau of Labor Statistics (BLS), the 2018 median pay for optometrists is $111,790 annually. On top of that, job growth is projected to increase by 10% from 2018 to 2028, which is a higher rise than other occupations.

Seeing as the university is in Southern California, you also want to think about employment and salary in California if you plan on staying in the area after graduation or consider other cities to live in.

Data from the BLS states that there are 3,760 people employed as optometrists in California, with an average salary of $117,180. While this is about $6k higher than the average, consider the high cost of living in California, which could easily eat up that $6k in a heartbeat.

It’s generally recommended that you not borrow more than your annual salary, so keep that in mind if you’re thinking about attending this school.

Going to MBKU could be a good option if you have a plan to work in the private sector after graduation or to have your loans forgiven while working in the public sector.

Managing student debt through forgiveness and refinancing

For optometrists who graduate with steep debt loads, there are some student loan forgiveness options if you have federal student loans. If you choose to work in the public sector, you can take advantage of Public Service Loan Forgiveness (PSLF). Through this program, you can get all of your loans forgiven, tax-free, after serving for 10 years and making 120 payments.

You can also go on an income-driven repayment plan and limit your payments to a small portion of your discretionary income. After the repayment term of 20 to 25 years, you can have your remaining balance forgiven. However, you’ll pay taxes on that amount, as it’s considered taxable income under this program.

Another option is paying back your loans ASAP. If you want to accelerate your repayment, you can consider student loan refinancing, which allows borrowers to apply for a better interest rate. You need to be aware that you’ll end up paying off your federal loans with the refinancing loan, therefore giving up important protections like forgiveness.

Refinancing should be reserved for borrowers who want to pay off their loans ASAP and don’t need forgiveness. Good credit is typically required for approval. The good news is that refinancing can save you thousands of dollars, depending on the rate you get.

Evaluate your options

Before deciding if the Southern California College of Optometry cost is worth it, consider all of your options. Are there more affordable schools that will give you the same results? What type of jobs are you looking for after school? What will your monthly payments look like? Look at the big picture before determining if MBKU is worth your investment.

If you need help deciding, we offer a predebt consult that can provide guidance. We know how stressful student loan debt is and can offer you peace of mind.