If you’re a doctor, you’ve probably been thinking about your student loans since the day you began medical school. And you likely know you need a plan for your massive medical student loan debt.

The Public Service Loan Forgiveness (PSLF) program is a popular student debt relief option for medical professionals. It's often the main plan for doctors to wipe out their student loans in as little as 10 years. Doctors can enter this repayment program as soon as they begin residency.

If you’re counting on PSLF, where you choose to complete your residency can decide if you’re eligible or not. Below, we explain why for-profit residency hospitals can trip up medical professionals who are pursuing PSLF. We'll also discuss how to find PSLF hospitals near you.

A review of PSLF

The PSLF program is a government student loan forgiveness option. Doctors and medical professionals can qualify for this program by working full time at a qualifying employer (you'll need employment certification). The following can be considered qualifying public service employment:

- Government organizations at any level (federal, state, local or tribal)

- Not-for-profit organizations that are tax-exempt under Section 501(c)(3) of the Internal Revenue Code

- Other types of not-for-profit organizations that are not tax-exempt under Section 501(c)(3) of the Internal Revenue Code, if their primary purpose is to provide certain types of qualifying public services

Note: You can also qualify for PSLF by volunteering full-time for AmeriCorps or Peace Corps.

Making sure your place of residency qualifies as a nonprofit or public service organization is only the first step. You’ll also want to make sure your loans are all federal Direct Loans from the U.S. Department of Education and that you sign up for a qualifying student loan repayment plan. Federal Family Education Loans (FFEL) and Perkins Loan) Program don't qualify but can become eligible if they're consolidated into a new Direct Consolidation Loan.

If you meet the eligibility requirements listed above, you can start the PSLF form — you can access the Public Service Loan Forgiveness form here. If your application is accepted, your eligible loans will be moved from your current servicer to FedLoan Servicing.

That said, after making 120 qualifying payments, your remaining balance will be forgiven tax-free. Even better, those eligible payments don’t need to be consecutive.

The average doctor graduates with $200,000 in medical education debt according to the AAMC, the benefit of working at PSLF hospitals could be in the six figures. You can see why you would want to get started on this student loan forgiveness program as soon as possible while working in public health.

Get Started With Our New IDR Calculator

How choosing a for-profit residency affects PSLF

Your desired location for residency may land you in a for-profit hospital — especially with major hospitals being sold to for-profit Hospital Corporation of America (HCA). If this happens, you can’t begin your PSLF program until after your residency.

This means that for at least three to five years, you’re making student loan payments without having them count toward PSLF. At this point, you have two options to compare.

Option 1: Enroll in an income-driven repayment plan and minimize cost during residency. Then sign up for PSLF.

Let’s say you enter your residency at a for-profit hospital with $190,000 of student loan debt with an average 6.5% interest rate. You’re eligible to enroll in an income-driven repayment (IDR) plan under Pay As You Earn (PAYE). Let’s also assume you’re making an average of $57,000 per year and your monthly payments are $323.

Over the course of a five-year residency, you’d put $19,380 toward your federal student loans. Your educational loans would have still grown due to interest during this time. Each year, $12,350 of interest is added to your principal balance, making the total you owe about $232,370.

After residency, you could begin PSLF, but you’d most likely be making a significant amount more. The average pay for a physician is $208,000 per year, according to the Bureau of Labor Statistics, so let’s use that number.

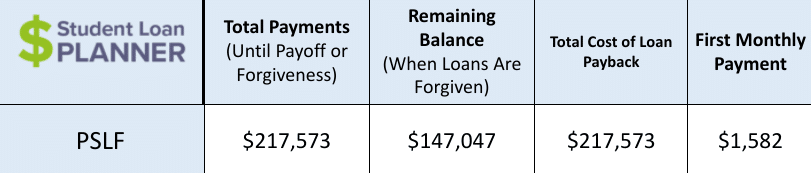

We see that you’d make the minimum payments for 10 years. Your first payment would be $1,582 per month, but this could increase if your pay or household income rises. At the end of 10 years, you’d have approximately $147,047 of student loan debt forgiven and will have paid a total of $217,573.

Those few years of not being in PSLF while at a for-profit hospital definitely would have cost you in the long run. But not as much as refinancing would.

Option 2: Refinance your student loans for a lower rate and begin payoff

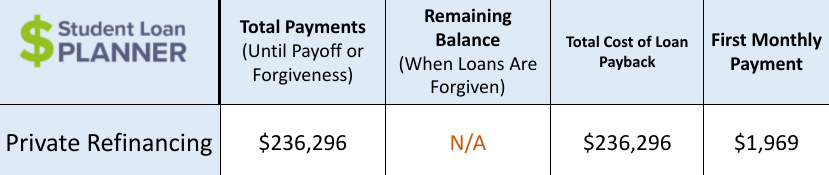

You can refinance your student loan debt for a lower rate — under 3% in some cases. But here we'll assume you refinance at 4.5% with your original starting balance of $190,000. You would pay a total of $236,296 to pay off your student loans over a 10-year period.

PSLF vs. refinancing

The bottom line is you’ll save more money by working at PSLF hospitals and pursuing forgiveness than refinancing your federal loans.

While staying on an IDR plan during residency and then joining PSLF will take five years longer than a standard refinancing payment term, you’ll have more money in your pocket by the end of it. That said, you run the risk of the program going away, as is true with anyone currently on PSLF.

If you plan to stay in the private sector or move to private practice, you can’t even consider PSLF. It then makes sense to refinance your student loans or opt for an income-driven repayment plan.

How to find PSLF hospitals

The availability of hospitals that qualify for PSLF near you will depend largely on where you live. For example, there are currently seven states in which over 90% of hospitals are non-profit hospitals or state hospitals according to the Kaiser Family Foundation (KFF). However, in four states, the percentage of PSLF hospitals is below 30%.

If you're wanting to see if a hospital near you qualifies, you can search for it on Guidestar's directory or nonprofit organizations. You can also use the PSLF Help Tool to search for eligible employers. Finally, it can't hurt to simply ask your recruiter about a hospital's for-profit or non-profit status during your job interview.

What about opting for an income-driven repayment plan instead?

You may decide to stay working in the private sector. If you already signed up for the IDR loan repayment program during residency, you can continue to stay the course. Keep in mind, this plan is less desirable than PSLF for two major reasons:

- You’ll make payments for 20 to 25 years, and

- You have to pay taxes on the amount forgiven.

Of course, you can’t help this when working in the private sector. You can, however, make sure that you choose a repayment plan that costs you the least amount of money.

What payment program should you be on for PSLF or IDR?

Both PSLF and IDR forgiveness require the borrower to be on an eligible IDR repayment plan. The qualifying repayment plans are:

- Income-Based Repayment (IBR)

- Income-Contingent Repayment (ICR)

- Pay As You Earn (PAYE)

- Saving on a Valuable Education (SAVE), formerly called REPAYE

If you still decide to pursue PSLF after residency — or IDR during residency — the payment plan you choose impacts how much money stays in your pocket. In the example above, PAYE was used because it’s one of the plans that keep your payment low.

Choose the plan that allows for the lowest monthly payment, even if this means your student loan balance will grow. PAYE and SAVE / REPAYE are the best options, since they take only 5% to 10% of your discretionary income. You can lower your monthly adjusted growth income by maxing out your pretax retirement accounts.

The idea is to capitalize on forgiveness. Keep to the minimum payments and don’t make extra payments, as those will be a waste of your money.

Weighing all of your options for loan forgiveness

There are more student loan forgiveness options for healthcare professionals available. Take into consideration what a for-profit hospital PSLF approach will look like for you compared to the IDR loan forgiveness route, as well as how other programs might help.

State-specific loan forgiveness programs and loan forgiveness for areas in high need of primary care offer incentives and loan forgiveness. If you have the freedom to do so, these plans can knock out a good chunk of student loan debt.

In 2019, HCA introduced a student loan assistance program for providers who work at one of its for-profit hospitals. Currently, this program offers a monthly benefit of $150 if you work full-time and $75 if you're a part-time employee. While this is something to consider if you work for an HCA facility, it pales in comparison to your other student loan forgiveness options.

Still not sure which route you want to take? The professionals at Student Loan Planner® can help. We’ll run your specific numbers and provide a repayment plan that will allow you to live a full life in your new career. Reach out and schedule a consultation today.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).