When you graduate from college, it’s time to face your student loans. You know you borrowed money but might not be quite sure how much you owe in student loans.

When I graduated from New York University in 2011, I wasn’t sure how much I owed and was in for a surprise when I realized I still had $68,000 after I had already paid $13,000 over the previous five years. Knowing how much I owed helped me later create a plan to tackle the debt.

If you’re wondering “How much do I owe in student loans?” here’s how you can find out.

Get Started With Our New IDR Calculator

1. National Student Loan Data System

If you have federal loans and want to know your student loan balance, the first place to look is the National Student Loan Data System (NSLDS).

The National Student Loan Data System is the central hub for all information regarding your federal student loans.

Start by going to the NSLDS site.

Then click on “Financial Aid Review” to check out your student loan balance. Accept the privacy policy after reviewing to access your information.

You’ll be asked to log in with your Federal Student Aid ID (FSA ID). If you don’t have an FSA ID, you’ll need to create one.

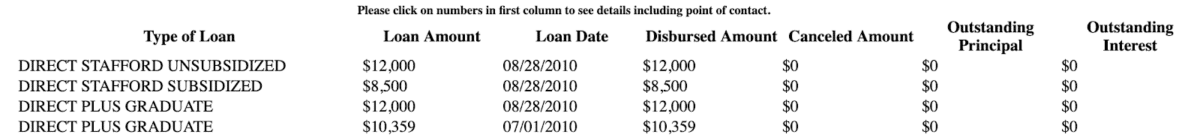

Once you log in, you’ll get to the page where you can see all of your loan information. Here’s an example of what it might look like:

This snapshot notes whether there’s still a balance or if the debt is paid off. In this example, the debt is fully paid, which is why the outstanding portion is zero dollars. On your account, you’ll be able to see the original loan amount and disbursement date, as well as your current outstanding principal and interest.

Having access to this information on the NSLDS site is a great way to keep tabs on how much in federal student loans you owe, how many loans you have, and how much interest is still outstanding. The database will help you get a big picture view of your student debt.

2. Annual credit report

The NSLDS site is good for federal student loan borrowers but isn’t useful for those with private loans. The NSLDS is run by the Department of Education, which administers federal student loans.

Private student loans are given out by private financial institutions. If you’re wondering “How much do I owe in student loans?” but you’re a private loan borrower, there’s another solution.

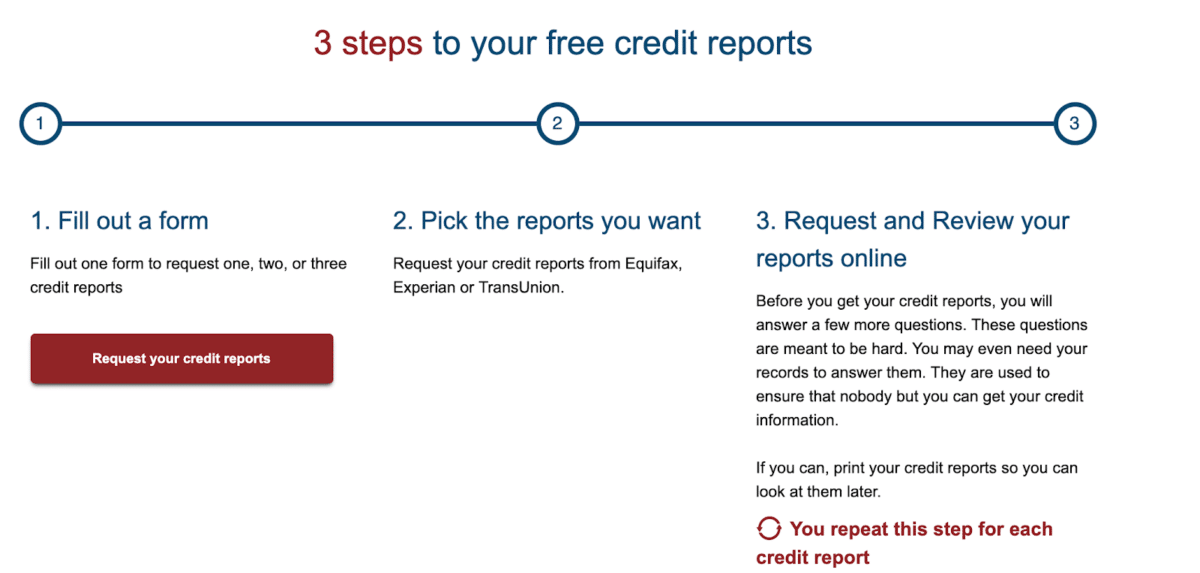

Access your credit report, which outlines all of your credit history. This also includes all your lenders and outstanding debt. You can get free access to all three credit reports from Experian, TransUnion and Equifax at AnnualCreditReport.com.

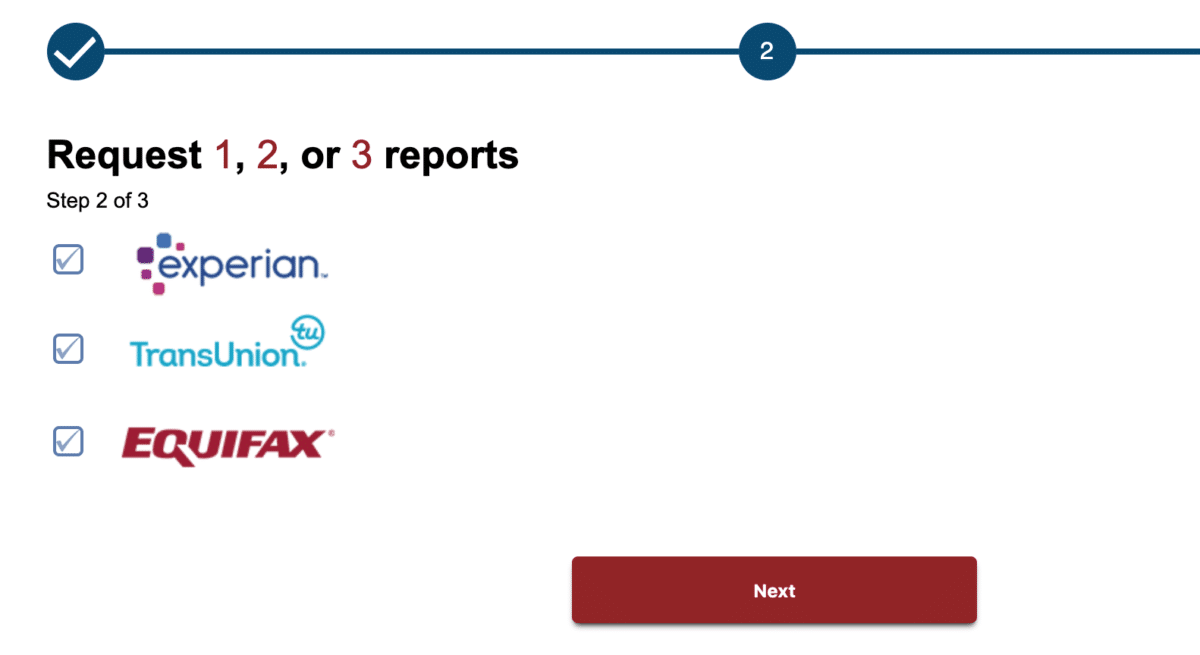

Start by going to the site and clicking the “Request your free credit reports” button. You’ll then see this prompt:

Fill out your personal information, including name, address and Social Security number. You’ll then be asked which credit reports you want to access. You should check all three, as some credit bureaus may have more information than others.

After that, you’ll be asked some questions to verify your identity. Once that part is complete, you’ll be able to access your credit reports. Then go to “Accounts” and you’ll see all of your outstanding accounts. This will include credit card and other loan information, but you should be able to identify your private student loans.

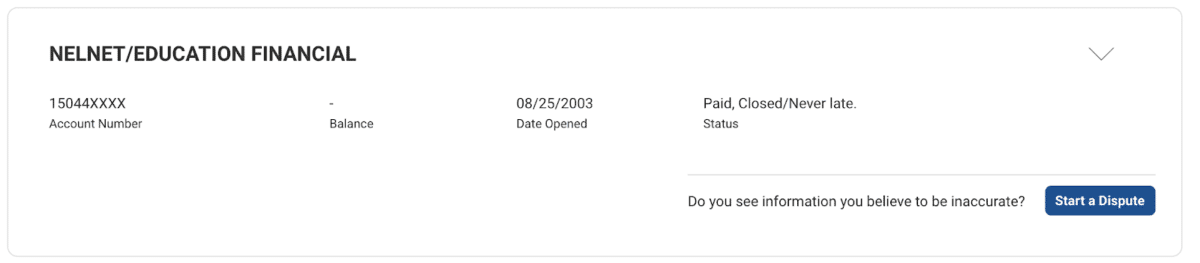

Below is an example of what a student loan record might look like for you:

Once you identify your private student loan lender or student loan servicer in the accounts section, you can see your student loan balance.

3. Health Resources and Services Administration

If you have medical-specific loans, you may have gotten them through the Health Resources and Services Administration (HRSA). If you have specific questions about your existing HRSA loans, you can contact the HRSA. This way, you can find your student loan balance and get information for medical-specific loans that may have been administered by the HRSA.

Why you need to know your student loan balance

“How much do I owe in student loans?” is a common question. You know you borrowed money to fund your education, but the exact amount might be unclear. You might even be in denial about how much you really owe and want to ignore your loans.

Trust me, I know how comforting it is (initially) to be in denial. But from experience, it will catch up with you, so facing your student loan debt head on is best.

It’s important to know your student loan balance for various reasons:

- You know the exact amount you owe.

- You know all of your lenders and loan servicers.

- You have the information for your accounts, so you don’t miss a payment.

- You can create a plan of attack once you know your student loan balance.

- You can review your monthly payments and interest rate.

Knowing all of this and taking action can help you pay back your loans, avoid delinquency and default, and be in control of your debt. If you're experiencing financial hardship and your monthly payment amounts are high you can look into deferment, forbearance, or other repayment plans such as income-driven repayment.

If you have federal student loan debt, you may also look into Public Service Loan Forgiveness (PSLF). To streamline repayment, you may consider consolidation loans or even refinancing to lower your interest rate.

While it can be tough to learn your student loan balance and see that number in front of you, doing so can help you create a clear plan with your student loan payments. Do you need help with your student loans? Get in touch for a custom plan.

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

Fixed 5.24 - 9.99% APR*

Variable 6.24 - 9.99% APR*

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.99 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 4.99 - 9.74% APR

Variable 5.89 - 9.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 5.44 - 9.75% APR

Variable 5.49 - 9.95% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 5.48 - 8.69% APR

Variable 5.28 - 8.99% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 5.24 - 10.99% APR

Variable 5.28 - 12.43% APR

|

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.