Most of the content about refinancing dental school loans talks about how much interest dental graduates could save and how fast they can pay down your debt.

Although that’s true, if you focus on only your dental student loans, you’re missing the forest for the trees. To get the best dentist student loan refinancing deal, you need to act in concert with your long-term practice goals.

Here are three strategies to figure out if you need to refinance student loans, when to refinance and how.

Here are our top 5 companies for refinancing dental school loans:

Laurel Road: Best for medical professionals

- Positives: Flexible repayment terms, profession based discounts

- Allows cosigners: Yes, cosigner release available after 36 months

- Deferment or forbearance available: Yes, up to 12 months

- Interest rates: Fixed starting at 5.44% APR; Variable starting at 5.49% APR

- Student Loan Planner® bonus: $300 for refinancing 50k to 100k, $1,050 for refinancing over 100k, OR interest rate discount if applicable.

While Laurel Road serves all borrowers, it is a must check for medical professions as well as Parent PLUS loan borrowers. They offer residency and fellowship refinancing and an additional 0.25% rate discount based on membership to different medical and dental associations. Laurel Road will automatically apply the better of our bonus up to $1,050 OR an applicable professional association discount you qualify for when you use our link to apply. *See disclosures

Splash Financial: Best for easy application

- Positives: Compares multiple lenders, good customer service available

- Allows cosigners: No

- Deferment or forbearance available: Yes, length and availability varies based on lender

- Interest rates: Fixed starting at 4.99% APR; Variable starting at 5.28% APR

- Bonus: $300 for 50k to 99k or $1,000 when you refinance $100,000 or more

Splash searches multiple lenders at once and provides a rate estimate very quickly. Their site provides one of the best user experiences, and you can get a rough estimate of how good your rate will be in the market as a whole by applying with them. Get up to a $1,000 bonus when you use our Splash Financial link to apply and refinance. Note that if you refinance $100,000 or more, $500 of the $1,000 bonus comes directly from Student Loan Planner®. Lowest rates displayed may include an autopay discount of 0.25%.

SoFi: Best if you're unsure where to apply

- Positives: Competitive rates, flexible terms and view rates in just two minutes

- Allows cosigners: Yes, but no cosigner release offered

- Deferment or forbearance available: Yes, in limited situations

- Interest rates: Fixed rates 5.24 – 9.99% APR; Variable rates 6.24 – 9.99% APR (rates include optional 0.25% AutoPay discount)

- Bonus: $500 for refinancing 100k or more.

SoFi continues to be one of the top companies by total refinancing volume. They offer residency, fellowship and Parent PLUS refinancing. Currently, SoFi is offering rate discounts for medical and dental professionals. In addition to a 0.25% autopay discount, there's 0.25% off for those with an MD, DO, DDS, and DMD degree as well as 0.25% off for refinancing at least $150k in loans. Get up to a $500 SoFi bonus when you use our SoFi link to see if you qualify and refinance your student loans through them. *See disclosures here

Earnest: Best for flexible repayment

- Positives: Flexible repayment terms, custom loan payments

- Allows cosigners: Yes

- Deferment or forbearance available: Yes, up to 36 months

- Interest rates: Fixed starting at 4.99% APR; Variable starting at 5.89% APR

- Bonus: $200 for refinancing 50k to $99,999; $1000 for refinancing 100k or more.

Payment flexibility and consistently low rates make Earnest a top lender Student Loan Planner® readers use when refinancing student loans. Earnest also services its own loans and has a Rate Match program that matches competitors' contractual interest rates. If you refinance $100,000 or more, you can get a $1000 bonus ($500 Earnest bonus + $500 from Student Loan Planner®). *See Earnest disclosures

Credible: Best for comparing multiple lenders

- Positives: Strong application experience

- Allows cosigners: Yes

- Deferment or forbearance available: Yes with some lenders

- Interest rates: Fixed starting at 5.28% APR (with autopay)*; Variable starting at 5.28% APR (with autopay)*

- Bonus: $1,250 bonus for loans over $100k, and $350 for loans $50k to $100k

Credible presents offers from multiple lenders, which offer varying rates, terms and perks like unemployment protection. The application experience with Credible is one of the fastest of any refinancing company. Get a $1,250 bonus on refinances over $100k or $350 bonus for loans under $100k when you use our Credible link. ($500 of the $1,250 bonus comes directly from Student Loan Planner®).. *See disclosures. Read rates and terms at Credible.com

Do you need to refinance dental school student loans?

Here’s a good rule of thumb: If your household debt-to-income ratio is below 1.5-to-1, you probably need to refinance your dental school loans. If you use our referral links, you might get anywhere from $100 to $1,275 in cash-back bonuses.

You might not hit that ratio until you’re a practice owner. After all, the American Dental Education Association estimates that the average debt for dental students who graduated in 2022 was $293,900. If you’re starting at a $120,000 associate salary, a 1.5-to-1 debt-to-income ratio would mean owing a student loan amount of less than $180,000.

Here are the only dentists I see who come out with less than $200,000 these days:

- Military dentists under HPSP scholarships.

- Received family help from parents, grandparents, or spouses.

- Went to a public in-state program, lived like a pauper, and waited tables every weekend.

- Worked a prior full-time job and saved money.

That means most dentists aren’t in a position to confidently refinance with a private student loan lender right out of school.

When is forgiveness better than dentist student loan refinancing?

From my experience consulting with hundreds of dentists and dental specialists, refinancing could be a poor decision if your debt-to-income ratio is above 2-to-1. Pursuing a forgiveness program with the Department of Education via an income-driven repayment plan, or IDR, could be better.

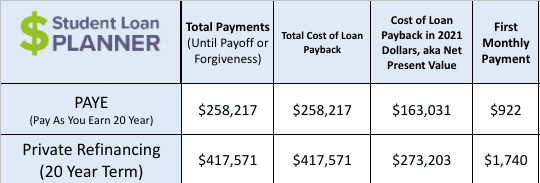

Let's say you earn $130,000 a year and have $300,000 of dental school loans at a 6% interest rate. You can refinance them at a 3.5% fixed rate for 20 years, or you can use Pay As You Earn (PAYE) and pay for 20 years. Here are the results:

You could save over $150,000 with PAYE vs. refinancing. Furthermore, because much of the cost comes at the end with PAYE’s tax bomb, you’ll pay even less in today’s dollars (note the federal government has suspended taxation on student loan forgiveness until December 31, 2025). You can model this scenario yourself with our free calculator.

One exception to this rule, however, is if you happen to work for a state facility or nonprofit clinic that would make you eligible to join the Public Service Loan Forgiveness (PSLF) program.

With PSLF, you can earn forgiveness twice as fast (in as little as 10 years), and you won't pay taxes on the forgiven loan balance. Unfortunately, far fewer dentists than doctors qualify for PSFL due to eligibility requirements. But if you do happen to work for a qualifying PSLF employer, this will almost always be your best option.

When you should refinance your dental school loans

Refinancing right before you plan to buy a private practice can be a bad move. Practice bankers I’ve spoken with prefer you have as low a monthly payment as possible so you can qualify through underwriting when buying a practice.

Refinancing too soon can also create problems with qualifying for a home purchase. I’ve helped a reader refinance again from a 10-year to a 15-year loan term because he was trying to get a mortgage, and the percentage of his income going to debt was too high.

Here are three rules to follow if you're considering refinancing your dental school loans:

- The required monthly payment should be easy to make (i.e., less than 20% of income). Feel free to pay more than that since none of our partners charge prepayment penalties.

- You should generally use SAVE (formerly REPAYE) before a practice purchase or partnership buy-in because of the interest subsidy. Remember, you can update your income to a lower number once you quit your associate job.

- Once you’re comfortable in your practice, you only need one year of good tax returns to refinance.

Can dentists still qualify for student loan repayment programs after refinancing?

Yes! Here are a few popular loan repayment options that dentists may still qualify for after refinancing their student loans.

- VA Education Debt Reduction Program (EDRP): This program offers up to $20,000 per year for up to five years ($200,000 maximum benefit!) for dentists and other healthcare professionals who agree to work for the VA in difficult-to-recruit, direct patient care positions. Learn more about VA EDRP.

- National Institutes of Health Loan Repayment Programs: Through these eight loan repayment programs, qualifying medical workers (such as dentists, primary care physicians, and clinical pharmacists) can receive up to $50,000 in loan repayment assistance per year for conducting mission-relevant research.

- Indian Health Service Loan Repayment Program: The IHS Loan Repayment Program can provide up to $40,000 in loan repayment for eligible medical professionals who serve American Indian or Alaska Native communities at an approved site.

- National Health Service Corps State Loan Repayment Programs: Many states offer loan repayment programs designed to attract workers from medical professions (such as dentistry) to work in a Health Professional Shortage Area (HPSA). See our full list of state loan repayment programs.

Unlike PLSF, none of these programs require borrowers to have Direct Loans to qualify. So, you can confidently find a lower interest rate today by refinancing without the fear that you could be sacrificing potential repayment assistance down the road.

How to refinance dental school student loan debt

Most borrowers simply want to find the lender offering them the lowest interest rate on a new loan. That makes sense. But if multiple private lenders offer you similar lower rates, here are four more factors to consider:

- Fees: Are there any origination fees, application fees, or prepayment penalties?

- Payment flexibility: Does the lender offer a solid variety of repayment terms, hardship forbearance, academic or military deferment?

- Discharge: Will your student loans be discharged if you die or become permanently disabled?

- Benefits and discounts: Does the lender offer special perks for dentists (like lower payments during residency) or interest rate reductions?

Other factors to consider include the lender's customer service reputation and whether or not it offers a refinancing cash bonus.

Where to shop for dentist student loan refinancing

You can find some of the best refinancing deals through one of the following lenders:

- Laurel Road: American Dental Association (ADA) members receive a 0.25% interest rate discount with Laurel Road. Get up a $1,050 cash bonus by using our link.)

- SoFi: If you refinance more than $100k with SoFi, you'll get up to a $500 bonus directly from Student Loan Planner® regardless of association membership.

- Earnest: Offers up to 180 different repayment terms to help you find the right monthly payment for your budget. Borrowers also have the ability to skip a payment once every 12 months. Student Loan Planner® readers can get an Earnest cash bonus of up to $1,000.

If you apply with one of the referral links above, you’ll generally qualify for cashback bonuses or rate discounts you wouldn’t receive if you apply directly.

Getting a pre-qualified rate at each lender only takes a few minutes. I suggest going with the best two and taking the next step of including payoff statements and pay stubs or tax returns and consenting to the hard credit check.

Sometimes dentists ask me if they should be worried about refinancing hurting their credit score. The answer is no since it generally impacts only a few points.

We’re the experts in dentist student loan refinancing

To be a top-performing dentist, you probably want a team of professionals to help you maximize your earnings and chances of success. If you use this free info to make a decision on your own, I totally respect that.

If you’d prefer to get professional expertise, our team has made custom plans for more dentists than any other group in the country. No one understands the dental and dental specialist field better when it comes to navigating dental student loan debt.

Reach out by email or use the button below, and let us know what you’re thinking about doing with your dental school debt.

Have experience refinancing your dental school loans? Have questions for our experts? Ask below in the comments!

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

Fixed 5.24 - 9.99% APR*

Variable 6.24 - 9.99% APR*

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.99 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 4.99 - 9.74% APR

Variable 5.89 - 9.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 5.44 - 9.75% APR

Variable 5.49 - 9.95% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 5.48 - 8.69% APR

Variable 5.28 - 8.99% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 5.24 - 10.99% APR

Variable 5.28 - 12.43% APR

|

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).