This update is meant to focus on our Student Loan Planner® business, but I want to start on a personal note.

When's the last time you remember being together with your entire family?

For me, it was when I celebrated my 30th birthday in New Orleans in January 2020. We walked down Bourbon street without a care in the world, bumping into passersby, assuming that the news coming out of China about a novel virus was just another thing on the news like SARS, bird flu, etc.

Hopefully when I write our 2021 year in review post, we'll all get to enjoy normal lives and big family trips again.

2020 was tough, but many of you went through worse. My wife got laid off in 2020, I lost my grandmother to COVID, but I became a dad with the birth of my daughter. I celebrated the New Year with my parents, but through a window since they were infected. It was nice to be able to bring them food, but it was super weird.

2020 was a reminder that my business, income, career success, and other professional metrics do not matter as much as I pretend they do.

Just as I saw so many highs and lows personally, the same happened for the business in 2020.

In the first quarter, Student Loan Planner® was setting all kinds of records for how many people we were helping, the amount of loans people were refinancing, and the number of folks taking our investing course.

Then, like many businesses, we got punched in the mouth about as hard as you could imagine.

So how did we handle 2020? If you want to read how we did in 2019 and how we did in 2018, I'll be pulling comparisons from that post.

First We Were Breaking Records

If you recall the economic environment pre-COVID 2020, things were booming.

In one month, readers refinanced eight figures of student loans on our site with a single company (we have multiple refinancing partners). Then the same thing happened the following month.

I thought there was a solid chance we were going to blow our 2020 goals out of the water.

But then on March 12, 2020, the NBA player Rudy Gobert tested positive. Shortly after, I found out Tom Hanks had tested positive. I could tell the markets were going to nosedive.

Then on March 13, 2020, I got inundated with reader emails when President Trump held a press conference suspending student loan payments and interest until further notice.

What was I supposed to say? This had never happened before, and certainly no one knew a President could even suspend payments and interest like that.

Then we saw the $2.2 trillion CARES Act, which codified these suspensions.

Then I Went into Freak Out Mode

If you owned a business that got shut down during the March and April time frame, I'm sure you can relate to my emotions during this time.

While we have no physical location or huge debt payments to make, I was expected student loan consults and refinancing would fall 95% or more.

Why would readers hire us for getting a plan when they didn't have to make any payments on the loans we advise on?

Furthermore, yes there's over $100 billion of private student loans out there, but what lenders will want to lend when credit risk is off the charts and we're expecting the next Great Depression?

So I asked our writers to cut back their article production significantly. I asked our team to cap their hours, reduce the number of projects they were working on, and cut our ad spending to virtually nil.

In other words, I was preparing our business to do whatever it took to survive the next Great Depression.

Sure enough, lenders started pulling back. Some virtually halted lending completely. After the stimulus started entering the economy, things started to change though.

When I Realized Our Business Would Survive 2020 Without Massive Cuts

I know that our student loan consulting business is about making long term plans. My fear from a business perspective in 2020 was that readers would just stop booking plans and I'd have to make a bunch of layoffs.

And yes, people get laid off, the economic goes through ups and downs, and needs change. Obviously, if student loans all got cancelled, we would need to pivot to provide a valuable service or close down shop.

But it still was pretty lousy thinking of how much it would set me back if I wasn't able to keep our team together for something like a temporary suspension of student loan payments and interest.

However, people kept booking plans in about the same numbers as before the pandemic.

The extra money borrowers had from not having to pay their loans caused many people to decide to invest in getting advice for those loans.

It also resulted in many people wanting to learn how to invest and buying our investing course. Close to 1,000 people signed up for that course in the past year alone.

As the Federal Reserve supported credit markets and lowered interest rates, it resulted in lenders returning to the student loan refinancing marketplace.

Back in early April, I'm not sure if even the most qualified borrower could get a 5% rate on her private student debt. Now that same borrower could qualify for something as low as 3.4% fixed for 20 years as I write this.

So consulting was pretty steady for us throughout 2020, even in the toughest times economically.

Refinancing really came back in a big way in summer 2020, and now we're seeing millions of loans get refinanced each month going into the new year.

So now I'll show you a few business stats for 2020. I share this because 1) I think it can help inspire you to create your own business and 2) because it shows how well or not well we're sticking to our mission of helping borrowers live their best lives financially.

Consulting Stats for Student Loan Planner® in 2020

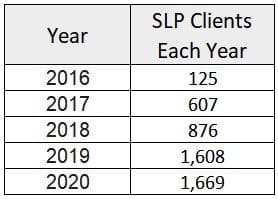

Here's how many clients we've had in each year since I founded the company in 2016:

We advised about the same number of clients in 2020 as in 2019 despite student loan interest and payments being suspended for almost 10 months.

Clients still needed guidance on how to consolidate, choose the right plan, get FFEL loans set up the right way, navigate debt paydown strategies, and how to reach financial independence despite student loans as large as a mortgage.

The total debt for our clients we helped 1 on 1 this year? Just over $408 million.

We've now personally advised $1.24 billion of student debt since we launched SLP in September 2016. To my knowledge, that makes us the largest group in the country that's helping borrowers in a 1 on 1 capacity. We're also about to reach our 5,000th client, which I never thought would happen when I started this company.

For 2021, I'd like to get to the point where we've advised $1 of every $1,000 dollars of student debt in America. That would mean advising about $500 million of student loans in 2021. I just hope everyone doesn't wait until October, November, and December.

Borrowers We Helped Indirectly

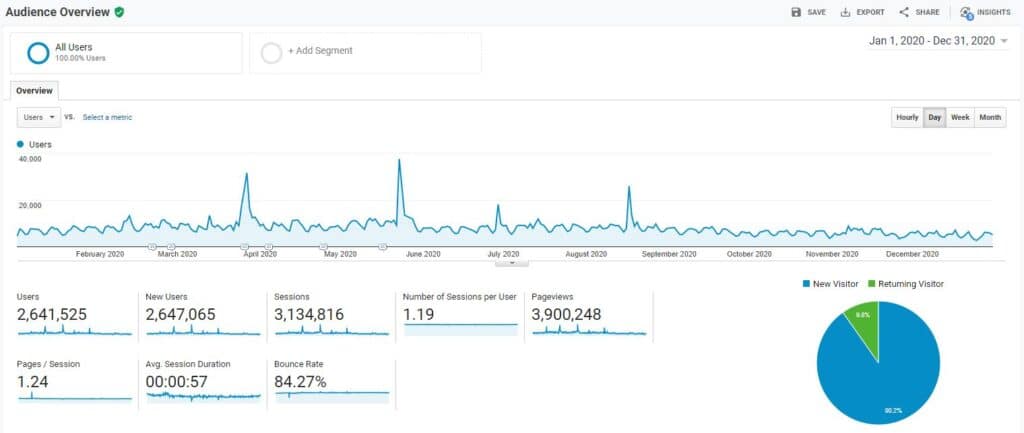

I share more stats below, but assuming most of the people who read our website in 2020 owed student loans, we reached about 5% of all student loan borrowers in America this year.

When deciding what articles to write for our editorial calendar, we often choose to produce content that will not make us a dime.

For example, some of our most popular posts in 2020 were focused on helping people access federal student loan relief who were in default or having their tax refunds garnished.

But SLP is a mission driven company, which means as long as we can stay in business, I want to be helping 100 times the number of people who can afford to pay us with our free content.

Refinancing Stats for 2020

In 2018, we refinanced around $75 million in student debt and in 2019 I think we were somewhere between $100-125 million. In 2020, readers refinanced about the same amount of debt as they did in the year prior.

And honestly, that's shocking! Student loan interest was suspended for most of the year! Over 90% of all student debt was 0%, and you can't compete with 0% no matter how good your rate is.

Refinancing revenue remains our biggest conflict of interest. It's easier to tell someone to refinance than use more complicated student loan forgiveness strategies.

Some websites out there design their content around getting you to the conclusion that you're a bad person if you don't pay back your debt, or that you'll never be rich if you don't get to zero debt.

That advice pays the best, but it's often the wrong advice. In some cases where PSLF is the best option, it's borderline financial malpractice. Yet humans respond to incentives.

In their defense, you can choose the wrong student loan strategy and if your savings rate is excellent, it won't matter. And if you convince someone to have a high savings rate by hating debt, then it's wise advice even if it's mathematically wrong.

Of course, believing that student loan forgiveness and student loan reform will bail you out is an equally bad idea if you don't have a plan.

With advice surrounding paying off student debt and refinancing, I've consistently gotten more conservative.

That's just because of policy trends. Here's my advice over time:

- 2018: If your debt to income ratio is lower than 2, refinance

- 2019-2020: If your DTI is below 1.5 to 1, refinance

- 2021: If your DTI is below 1.25 to 1, refinance

You can always refinance if your debt to income ratio is higher than that. It's still a defendable position even if your debt to income ratio is a bit above 2 to 1, because maybe you don't want to file taxes separately, or you're expecting a big income boost or inheritance, or maybe you just don't want loans hanging around for 20 years.

I don't blame you.

One thing we did do at the tail end of 2020 is make our refinancing bonuses the best in the world. Very shortly, you won't be able to find a collection of bonus and incentive offers like ours for student loan refinancing anywhere.

That's because as a mission focused company, we negotiate hard for bigger payouts that we share with our readers, unlike other companies that keep 100% of their refinancing revenue. That's taken years to achieve, but I hope it will continue to allow us to save readers money.

In total, I estimate we've now distributed over $2 million to readers in cash back bonuses that would've gone to us instead if we had just kept it. I'm proud of that.

How Many People Checked Out Our Blog Posts in 2020?

You can see the growth of site traffic below. Traffic roughly tripled from 2018 to 2019, then it more than doubled from 2019 to 2020. That's not too bad in a year where student loans were on the backburner for many.

I work in the student loan world everyday, and I can confirm I googled daily COVID stats a lot more than I searched student loan stuff.

Site stats are just a vanity project if they're not helping people out.

But it's cool to be consistently helping more readers each year. I have no idea what site traffic will be like in 2021 now that interest and payments are suspended even further, but I think we'll do a good job helping those who do stop by.

Most Viewed Posts of 2020

Here's our top 10 most viewed posts from 2020.

- Here's What the Stimulus Plan Will Do to Your Student Loans – 129,620 views

- How to Handle the Student Loan Tax Offset – 117,001 views

- Using Biweekly Payments to Pay Down Debt Faster – 109,334 views

- The Highest Paid Types of Lawyers – 88,871 views

- Top Jobs of the Pandemic Recession – 83,876 views

- Cheapest Medical Schools – 78,164 views

- Avoiding Student Loan Forgiveness Scams – 69,129 views

- Student Loan Forgiveness Under President Trump – 68,112 views

- Top Grants to Pay Off Student Loans – 64,145 views

- Worst Jobs for Mental Health Due to Student Loans – 62,917 views

We did plenty of unique surveys in 2020 that resulted in some interesting data showing which professions were hit hardest by the pandemic.

We also covered topics on the stimulus plans and how borrowers could take advantage.

We will never beat news outlets to the punch detailing breaking stories about student loan policy, but our articles make up for that in the depth of analysis, which I think is what readers want from us.

Podcast Downloads in 2020

We had about 138,000 downloads of our “Student Loan Planner® Podcast” in 2020.

Some podcast hosts I know guard their show download numbers like a state secret. I recognize people would rather listen to true crime then detailed breakdowns of how the REPAYE interest subsidy works.

So I'm glad we fill a niche in the podcast world for people who want to learn a lot about growing wealth when you owe a bunch of student loans.

Here's our top 5 most downloaded episodes:

- Student Loan Hacks You Haven't Heard Before (published 1/23/20)

- How to Go from a Six Figure Debt to a Six Figure Net Worth (published 12/28/19)

- What the Trump Student Loan Order Means (published 8/16/20)

- Why You Might Pay Nothing and Borrow the Max (published 5/10/20)

- The Coming Chaos in Student Loan Servicing (published 7/8/20)

How Did We Do with 2020 Goals?

Here's the marks I set below for 2020. We failed at virtually all of them because I did not anticipate a global pandemic, but we did really well all things considered.

- Get to 500,000 monthly visitors from search traffic (We averaged around 200,000)

- Hit 5,000 downloads per podcast episode (we're anywhere between 1,000 and 2,000 per episode)

- Reach 120,000 annual users from social, including 2x the Pinterest and 10x the YouTube traffic (I think we're about half of that)

- Create content where you are the hero (kind of ambiguous, but hopefully we did that)

- Hit 50,000 email subscribers (we're about 13,000 short of that goal).

- Hit 10,000 YouTube subscribers (far below, around 2,000 so we can do better there)

- Reach the point where we've advised 0.1% of all student debt in America by the end of 2020 (will likely hit that goal in 2021)

- Refinance $400 million of student loans (about 30% of that, which is pretty great all things considered)

- Triple our 2020 revenue while continuing to invest in the business (we doubled it but didn't triple it)

- Host an in person meetup with all of our team (That obviously didn't happen. Here I was in late March 2020 thinking we wouldn't have to cancel our late May team meeting.)

- Save at least 5 lives this year (I can't track that directly, but given how often our suicide prevention and mental health articles are viewed I hope we contributed to making borrowers love themselves and not feel trapped by their debt).

Revenue and Expenses for 2020

Our margin was about 59%, which was higher than last year's number of 44%. I ended up overreacting in the first half of 2020 because of the pandemic and cut expenses a lot more than I would have if I had known we would make it through pretty unscathed as a business.

I actually aim for a 30% profit margin. That's just because it allows me to pull out some profit while still investing substantially in growing the business.

I'm sure I made a lot of mistakes with how I've allocated capital as a business owner, but it's cool that our revenue has roughly doubled each year since I started SLP in 2016.

I seriously doubt that trend will continue in 2021 unless a lot of things fall into place perfectly. So my goals for 2021 are much more muted than they were in 2020.

Our Goals for 2021

Now I can set some goals for 2021.

- Get to 300,000 monthly visitors from search traffic

- Hit 5,000 downloads per podcast episode

- Reach 10,000 subscribers on our YouTube Channel (subscribe here 🙂

- Hit 50,000 email subscribers

- Reach the point where we've advised 0.1% of all student debt in America

- Refinance $200 million of student loans

- Equal or surpass our 2020 revenue while continuing to invest in the business

- Host an in person meetup with all of our team (I really hope this happens. My wife's medical conference all seem to be booking venues for November and December. Let's all hope!)

- Save at least 10 lives this year through our content that promotes mental health wellbeing when you're struggling with debt anxiety

Obviously President Biden extended the student loan interest and payment freeze. Who knows what that brings in 2021. We will try to add some more team members as our revenue allows, including 2 new consultants in early 2021.

I think my main goal is just survive 2021. That sounds ridiculous given we had a much better 2020 than I ever dreamed possible, but it's an honest answer.

Readers reach out to me constantly sharing inspiring stories of what they were able to accomplish with a little help from our content.

Those goals above would be great, but they represent changing lives, and that's what our purpose is as a business.

Hopefully I can remember that you are our main focus and not get distracted by stress, noise, and anxiety around managing a business that's larger than I had anticipated. I'm much better at eliminating the debt anxiety of others than I am at managing my own.

Thank you for reading, sharing, and engaging with our content. I really appreciate it so much and it's very rewarding.

Do you have goals for 2021? Or just comments in general? Feel free to share.

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

Fixed 5.24 - 9.99% APR*

Variable 6.24 - 9.99% APR*

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 5.19 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 5.19 - 9.74% APR

Variable 5.99 - 9.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 5.44 - 9.75% APR

Variable 5.49 - 9.95% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 5.48 - 8.69% APR

Variable 5.28 - 8.99% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 5.48 - 10.98% APR

Variable 5.28 - 12.41% AR

|

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).