If you're a veterinarian, want to be one, are in training , or love someone who is, you should know about the extreme unfairness toward the animal health profession that exists today. Veterinarians are treated horribly under student loan repayment rules. Students graduate with huge balances, are not eligible for the best student loan forgiveness options, and don't earn high enough incomes to pay back their debt.

To top it off, most of their peers in human medicine have access to a massive loophole in the student loan rules that many veterinarians don't. This results in veterinarians paying hundreds of thousands of dollars more on their educational loans than human doctors making five times their salaries. This piece should serve as a call to action for the veterinary profession.

Veterinarian student debt among the highest of any profession

I've worked with hundreds of veterinarians in my student loan consulting practice. Their average student loan debt is $265,000. From what they've told me, most of their friends have debt loads that are a similar size. This is so wrong for a bunch of reasons.

First, the average med school grad I've spoken with has a lower balance. Regardless of what schools tell you, it has to be more expensive to educate a med student than a vet student. Why then does vet school result in so much higher student loan balances? I believe there is price gouging going on.

There are not many accredited vet schools to choose from. Because of the limited access, getting into vet school is harder now than getting into medical school. Since so many college students want to become veterinarians, schools have the ability to raise prices.

Some affordable options still exist, but the competition for these seats at state public universities is fierce. You're more likely to get a spot at one of the types of vet schools that will wreck your finances.

Furthermore, the federal government does not impose any caps for practical purposes on how much student debt you can borrow. In the absence of any market-imposed restraint on the cost of tuition, it grows steadily higher each year.

Hence, veterinarians start off with a crushing debt load. Unfortunately, I have far more serious evidence that veterinarians are treated horribly under student debt rules.

Veterinarians have little eligibility for the best forgiveness option, PSLF

Assume that you are a vet student who graduates with $300,000 in student debt and receives an offer of $80,000 a year at a private vet hospital. Your loan payments will never touch the high balance unless you dedicate 50% of your income to your debt. That's not a realistic proposition.

In the legal profession, a student could graduate with a similar debt load and work for the government for 10 years. After this period, the lawyer's entire student loan balance is wiped away tax-free thanks to the Public Service Loan Forgiveness program, or PSLF for short.

Veterinarians have almost no in-field not-for-profit jobs available to them. Sure, there are scattered opportunities here and there, but nothing widespread like a prosecutor or public defender jobs as in the legal profession.

For that reason, virtually all veterinarians graduate and take a job in the private sector. Because of the lack of nonprofit jobs, almost no veterinarians qualify for the PSLF program, which is by far the most generous benefit available to students today.

Some states offer veterinary medicine loan repayment programs. Unfortunately, the federal PSLF program makes them look irrelevant by comparison.

Pay is high enough to owe a lot each month, but not high enough to make a dent in your student loans

Veterinarians certainly make more money than the average American household. That said, of course they should. They have four years of freaking graduate level education! Unfortunately, vet salaries are far below those of human doctors.

No matter how much a family loves their dog, there just isn't the same financial desire to pay thousands of dollars for a surgery to save its life. Most families who face a huge vet bill to save their pet will instead decide to put the pet down.

It's very sad, and I've spoken with many veterinarian friends who want to save the lives of their patients but are not allowed to provide certain veterinary services because of financial constraints.

Even so, veterinary salaries are high enough to require large payments in the income-driven repayment (IDR) plans. Paying almost $10,000 per year toward your student loans is no joke.

That said, only paying $10,000 on a $300,000 loan amount does not even cover the interest. The federal student loan rules trap veterinarians. They have to pay big monthly payments when they graduate, but they aren't able to pay down their debt.

Refinancing vet school loans is difficult because of debt-to-income ratios

The average vet school debt for borrowers who owed money after graduation in 2019 was about $183,000 according to the AVMA. If you refinanced that debt amount at a 5% over 10 years, you would owe $1,941 a month, or $23,292 a year.

After a few years in the workforce, some veterinarians start earning in the $110,000 to $140,000 range with production bonuses included. Even if you make a decent income, paying 20 grand a year is no joke.

Most lenders want to see debt-to-income (DTI) ratios below two-to-one. That means if you earned $80,000, they would want to see student debt of less than $160,000. When young doctors ask me if I think they should refinance, I suggest that you follow this two-to-one DTI rule of thumb.

Since so many veterinarians have high student loan balances relative to their incomes, getting the low interest rate through refinancing that's needed to rapidly pay back debt in the first place is challenging. If you do work in the private sector and can afford to pay down your loans in 10 years or less, get a cash-back bonus for refinancing your vet school loans and aim for at least a 1% reduction in your interest rate.

The human doctor loan forgiveness loophole should make veterinarians furious

I'm going to show how unfair student loan policy is for the veterinary profession with a hypothetical example. I've made a super powerful, free calculator available here that I use to power these examples. Feel free to use it model your own student loans and explore various repayment options.

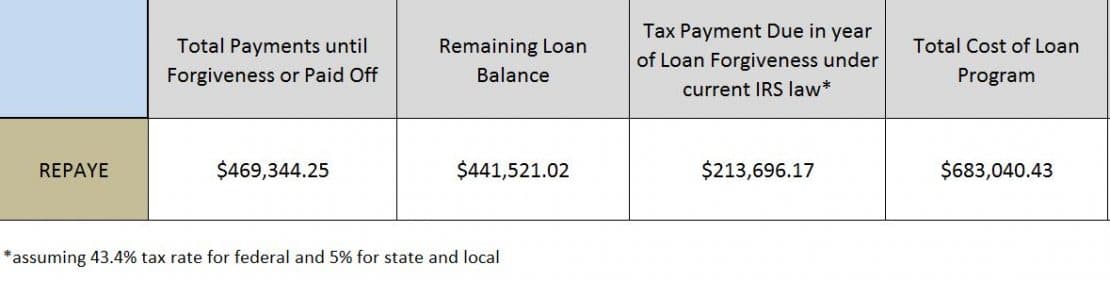

Assume Sarah the veterinarian graduated in 2012 and has been paying on her debt every year. She now has a $350,000 balance with an average interest rate on her consolidated loans of 7.25%. Sarah makes $85,000 a year in a private animal hospital.

She will never be able to pay off her debt completely making the monthly payments in the income-based forgiveness program.

However, she will be eligible for taxable loan forgiveness in 2037 and will have to pay income taxes on the forgiven amount that year. Here's how the cost looks:

So, her total cost is $683,000 for her veterinary education over 25+ years.

How four years of med school can cost less than one year of vet school

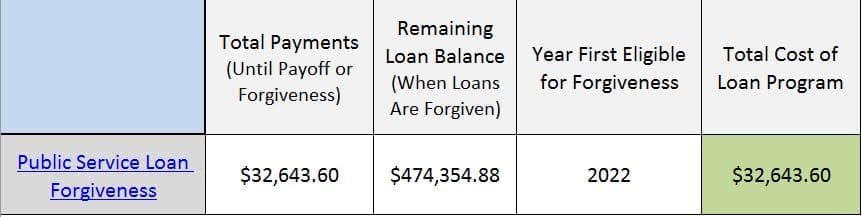

Now let's look at one of Sarah's friends Christine who went to medical school. She graduated in the same year 2012 and has been making payments since this time. Christine is about to start her fifth year of training in her neurosurgery residency. She wants to do a fellowship as well, which will allow her to keep her payments low for the first 10 years of student loan payments. Here's how much her loans will cost her:

Sarah the veterinarian will pay $683,000 over 25+ years to her student loans, and Christine the neurosurgeon will pay $33,000 over 10 years to her student loans.

Sarah the vet will be making payments her entire professional life, and Christine the neurosurgeon will have her $474,000 debt balance completely forgiven tax-free before she starts making over $500,000 per year as a fellowship trained human doctor specialist.

Not only do human doctors make five times as much in salary, but they can also pay 5% of the amount toward their student loans. After 10 years, the government COMPLETELY FORGIVES THE LOANS TAX-FREE!

Veterinarians are treated horribly under student loan rules, and it's the federal government's fault

How is this you ask? Human doctors work for not-for-profit institutions during their training. Therefore, they qualify for super low payments during residency and fellowship that count toward the PSLF program. After 10 years of payments, the federal government forgives their debt tax-free.

Veterinarians work in the private sector as there are not many not-for-profit vet hospitals. That means the forgiveness vets get comes after 20 to 25 years. Furthermore, the government treats that forgiveness as if someone handed them a check for $500,000. The IRS turns around and tells you that you now owe $200,000 in taxes.

If you are a veterinarian, you must be preparing for this huge vet school loan tax bill that you will likely face one day from the IRS. Hopefully Congress passes a law and does away with the tax bomb forever. However, do not plan that they will so you can be ready. Save a few hundred dollars a month in an index fund account at Vanguard or Betterment.

I don't believe Congress ever worried or thought about the horrible impact on the veterinary profession they had by passing new loan rules. If I was a member of the American Veterinary Medical Association (AVMA), I'd be up in arms. I'd write letters to all of my congressmen and congresswomen demanding equitable treatment for animal doctors and human doctors.

The federal student loan program does not work correctly. It's time for the veterinarian profession to rise up. It's time to put pressure on elected officials. Veterinarians deserve fair treatment under the law.

I can help you come up with the best strategy to pay back veterinary school loans

We have worked with a huge number of veterinarians to help them find the lowest cost repayment plan for their veterinary student loans. We charge a one-time fee and perform a holistic loan analysis to make sure you're not making a four-, five-, or six-figure mistake with loan repayment strategy.

*Note: We've written a bunch of free content for veterinarians struggling with massive student loans. If you'd like to see some of it, I suggest checking out the Vet School Section of the blog.

Thank you for a very well written article. We have a daughter going to Vet school . Your numbers are accurate and reflect our experiences with a student in Vet school.

AMA has always been a strong lobbying force. That is most likely the main reason why human doctors have such an advantage in both salaries and loan policies.

The only reason to go to Vet school is because it is your true passion not because it’s the best financial decision.

Thank you Jackie! If anyone has questions about what I wrote above, please feel free to ask me in the comments section.

I will say that I truly don’t believe the AMA got the loan treatment because of shrewd lobbying. I actually believe it was a total accident by Congress. The President’s budget last year sought to limit loan forgiveness benefits by income, which would make doctors ineligible for this PSLF benefit.

I would highly encourage any veterinarians reading this article to contact their elected representatives and ask that the tax treatment of forgiveness for student loans be the same for the public and private sector. It’s just not equitable. Also, keep in mind if you have a $300k+ loan balance coming out of vet school, then working full time at a veterinary college (which is a not for profit institution) would be a $50,000-$100,000 per year benefit because you’d qualify for PSLF.

Just a side note for other readers. Only Direct Loans qualify for PSLF (not all student loans). My husband and I have learned this the hard way. We are both veterinarians (2006 graduates) and at one time both of us worked at a veterinary college. He still does. Unfortunately, we consolidated our loans right out of vet school (fortunately at a rate of less than 3%), not knowing life would bring us back to careers in the veterinary college. Anyhow, he has applied for PSLF but does not qualify due to the consolidation/loan type.

Great point Lindsey. I speak to former vet students all the time from the class of 2006-2013 range who have Federal Direct loans in addition to FFEL loans, the latter of which are not eligible for PSLF. This is why I believe my $150-$200 flat fee consultation has so much value. If PSLF is in the picture because you’re one of the few vet med grads working at a not for profit, I make sure that your loans are set up the right way to get it.

There are also a lot of veterinarians out there who have no heard about the REPAYE program yet. I just spoke with a young woman who had a > $400,000 debt balance, most of it at 8.5%. I looked at the benefits and drawbacks of consolidation and sticking w IBR versus consolidating and going with REPAYE, and I’m 99% sure the financial aid offices are not going through these tradeoffs with students at all. The financial aid offices at Vet Schools are some of the worst in the country. My friend at UF Vet Med told me they don’t even have a dedicated counselor. Lindsey there’s a chance your husband’s loans might still make sense to use PSLF. If you’d want me to take a look, feel free to email me at travis@studentloanplanner.com. My thought is that he either used a private refinancing to get that 3% interest rate or is on a FFEL loan program that won’t support PSLF.

Hi Travis

This article is very informative yet, unacceptable! I have a daughter studying Veterinary medicine and will be extremely in debt upon completion of the program. Like everything else in our country priorities are unclear with this issue. Pets are a huge part in most of our lives especially, in human therapy not to mention in farming, and various branches of the United States Military. If we don’t have well trained and qualified Veterinarians to care for these animals what would we do? Correct me if i’m wrong, but a large majority of our presdents have had pets frolicking around the White House during their presidency. Evidently, they found the companionship of the four legged friends to be of importance to them. So why, wouldnt the student loan debt take presidence like human med debt? I think we need to investigate this issue and put some pressure on congress to do the same. After all, what would a world without pets be like??

Great points Kathy. Perhaps in veterinary medicine we need more of the equivalent of “Physician Assistants.” In exchange for lower salary, they could have a drastically lower debt loan from the vet schools. Just a random thought.

I truly believe the core of this problem is: 1) AVMA has no lobbying power, 2) small number of vet schools have a monopoly, therefore receive way too much demand 3) unlimited debt from federal government 4) combination of all these factors meaning vet schools jack up tuition 200% over several years bc they can, the feds finance it, the financial aid offices don’t help or explain it, and vet student bear the brunt of the policy failure

Just to inform you, we are called Physician Assistants, not “Physician’s Assistants.” Also, my student debt rivals that of medical students and veterinarians. I have >$200,000 in debt (purely for PA school as I was lucky to get academic scholarships for undergrad) and just graduated. It is accurate that we make drastically less money, but we also still have huge amounts of debt.

Great catch I wrote that comment a couple years ago and I wouldn’t have made that mistake today now that I know the PA world better than I used to. Updated my comment 🙂 I agree that PAs have a tough time too. Basically every graduate school level degree program is becoming a difficult financial choice in the absence of income driven programs.

Travis, you say that graduating veterinarians who gain employment full time at a not for profit veterinary college will qualify for PSLF. I’m wondering if you happened to know if this also applies for paid internships and residency if you are performing these at, say, a public university. This is a full time job (usually more), and they get to pay you a borderline sub-living wage and exempt you from paid time and a half because it’s an “educational opportunity”. If you want to specialize, you have to live this way through two 1-year internships, and a 3-year residency. Do you know if you can qualify for PSLF during this (barely) paid educational period or would it only apply after this 5+ year period if you get hired on by a school as a specialist? Because I’ve never heard of vet schools hiring plain ol DVM’s, its usually specialists and Ph.D.s

Hey Kat, here’s the definition of PSLF qualifying employment “You must meet your employer’s definition of full-time. However, for PSLF purposes, that definition must be at least an annual average of 30 hours per week.” If the university will classify you as Full-time AND your loans are set up correctly (something I can help do through a consultation), then by my reading of the rules it should count. If you’re in this situation now, please submit the PSLF employment certification form which you can find here https://studentaid.ed.gov/sa/es/sites/default/files/public-service-employment-certification-form.pdf

Here’s the PSLF program rules summary

https://studentaid.ed.gov/sa/sites/default/files/public-service-loan-forgiveness.pdf

You can learn all this stuff and implement yourself, which takes a lot of hours to learn, or you can hire me. That’s basically the business model. Happy if people would rather go learn themselves because they could help others

Jackie,

I left veterinary school after two years. It took that long for the curtain to be lifted back far enough to realize the broken system I was working to join. Once I saw the light I had to get out.

Please know that the AVMA is in fact an incredible organization, just like you say, but compared to the ADA or the AMA they have next to no influence. It’s a matter of scale, and quite simply the needs of a few veterinarians are easily outweighed by those of doctors and dentists. For the sake of my friends and former classmates I pray every day that I am wrong, but I see no end in sight to the systemic mistreatment of those who dedicate their lives to caring for animals and their loved ones. Best of luck to your daughter and your family; you too will be in my prayers.

Thank you Brian for your words. I almost got upset today because I did a consult for a vet with greater than $400,000 in debt, and it’s just so terrible because people are being so abused. If you’re not a financial minded person, you understand that vet school costs $30,000-$50,000 a year, but you don’t put it together that you’ll owe $300,000-$400,000 three to five years after graduation because of compound interest. I can’t work miracles, but I can help veterinarians by providing a thorough knowledge of the loan rules for a very low rate.

Also Brian, what did you leave vet school to do? Assuming you still had a pretty big loan balance.

” believe there is price gouging going on.”

This isn’t really true. Veterinary Medicine Colleges are the forgotten step child of the health sciences. These colleges have to run hospitals with ever changing equipment needs, secure facilities and animals for practical courses, and of course have to pay Doctorate level faculty. The funding per student for veterinary education is the lowest of all of the health sciences, therefore these colleges are required to self fund through tuition, self operate their clinics through earnings operations and compete with the graduates they are putting out, and through private endowments and donations. If you want to look at the problem with the cost of Veterinary Education, the very first place you need to look is at the funding at the state level.

Thank you for commenting Jim. I respectfully disagree, and here’s why. Doctorate level faculty could probably be paid $50,000 a year and actually make far more than their private sector counterparts in veterinary medicine. All faculty are full time employees of not for profit institutions. If a new veterinary student was able to go through a doctorate level program and become an assistant professor, the loan benefit would be worth between $70,000-$100,000 a year in extra salary after taxes because of PSLF tax free loan forgiveness.

If you add on the more generous benefit packages available to public employees in terms of retirement, healthcare, maternity, and other things, the professors at veterinary colleges are the most highly paid employees by far in the entire profession. Colleges could let go of untenured faculty, hire new graduates at $50,000 each, and cut tuition by 50% for vet school. That won’t happen though, because entrenched interests in the faculty at these institutions will prevent it.

I do agree that state funding cuts for public land grant universities is a tragedy and I will they would reverse this trend. Unfortunately, I don’t believe it has anything to do with the soaring cost of veterinary education.

How would you expect those new grads to teach students? New graduates need practice and development before returning to education. I went to vet tech school instead of vet school to avoid debt. It has worked out great for me. I teach RVTs now and will retire in 2032. I graduated in 2002 debt free thru scholarships and working. Don’t pick a career path if it will not be a good return on investment. Plus you can join the military as a veterinarian and they will pay to you to get specialty boarded.

I would make use of the senior faculty that were protected by tenure to teach the complex classes and the recent grads could teach first years, if I was making a policy proposal to a University President or Congress. Great points though Melissa!

With all due respect, do you realize that your “solution” is just another iteration of the same problem? You suggest hiring newly-minted PhDs as faculty members at $50k. These are the individuals who will teach the new vets, who you say make too little at $70-80k, right? First problem: paying the educators far less than you think the new vets should make.

Second problem: How do you think those individuals — new PhD holders now teaching full time for $50k — plan to pay off their own student loans? My own PhD was fully funded, but only 4 of us had fellowships out of my 12-person cohort. The other 8 were taking loans to the tune of $48k per year, for a 6 year degree program. Your the number-runner, not me, but how long would it take to pay off that balance while making $50k?

How can you, in good conscience, suggest that hiring young professionals with mountains of debt and paying them a low wage for their education level is a solution to student debt? Isn’t that the exact burden facing new vets? Low wages with respect to their education, leaving them unable to pay off loans?

Either you entirely undervalue educators, who are responsible for creating vets… or you simply think vets are more deserving than any other highly educated field?

Great points Karen. That’s why the PSLF tax free loan forgiveness program is so powerful. You could literally hire professors and pay them $50,000 and they would be BETTER OFF FINANCIALLY THAN A PRIVATE PRACTICE MAKING DOUBLE! It’s crazy right? Sometimes I find PSLF is a $1 million benefit. If you divide that among 10 years of salary and gross it up for taxes, some people could be earning loan benefits of $120,000 or more annually just by working in the not for profit sector.

So say you drastically cut wages for new faculty hires. You pay 10% of your discretionary income (~$300 a month) for 10 years, and the entire balance is gone because of PSLF. Poof. Nobody without debt would take these jobs, but a huge percent of vet students have debt at graduation. Someone mentioned the average is around $150,000. As more people catch onto the PSLF program, not for profit animal shelters and veterinary colleges will be the most popular and competitive employers in the profession. You could make people pay YOU for the privilege of working there.

I graduated vet school in 2015. There was not a single professor that wasn’t a board certified specialist. You cannot teach at a vet school–at any level–without an extremely impressive resume. A new grad is much more likely to get a job at a non profit shelter. There are many more non profit shelters than there are vet schools. As a new graduate with no specialty and no experience, it would be impossible to get hired at a vet school. I’m sorry to say your “solution” is, frankly, delusional.

That’s fair Nicole. I’m no veterinary doctor, just throwing ideas out there for discussion. Perhaps the non-profit shelter option is something more vets need to look in to, particularly the ones w >$300k debt. What if you could do some sort of side consulting for friends with animals but work primarily at the shelter? That way you could get the tax free loan forgiveness over 10 years, be done w your debt in your mid to late 30s, and open your own private practice?

another point to “teaching” is that there is also an ART to it and not everyone is good at it. Not everyone should be expected to do it unless they have an exceptional skill and a love for doing it. Doing it, just to do it, is not the way to go. Even first year classes are ultra important stepping stones to further years – physiology, anatomy, etc are so important and there is a HUGE difference to who is doing the teaching.

While I agree with your conclusion that there is a problem with the student debt and their options in the Veterinary industry, you are horribly misguided as to the level that the faculty at vet schools have achieved and the salary of Veterinarians. First off, faculty at a school like Michigan State, Ohio State, Cornell, UCD, LSU, TAMU, etc, are all going to be boarded veterinarians or have a postdoc degree at the minimum. Paying a postdoc or a Boarded Veterinarian $50k is downright insulting. Veterinary Residents are paid around $45k when you include their tuition benefit, and taking below $50k for a new grad out practicing is grossly underpaying. In our market, new grads are making $55k in general practice, and $90k 10 years in as an associate. An Associate professor makes $115k after 1 year of internship, 3 years of residency, and passing their boards. It’s also misguided to think that these veterinary schools have anything other than the best in the world teaching, because they are the only ones funded for research, to replace them with new grads is a ridiculous notion to be honest.

As for funding, I can tell you at a top 5 Veterinary school, the state provides direct funding of $30k per student for the other health sciences per year, and $15k per student per year for Veterinary.

Certainly mean no disrespect to the Veterinary Faculty Jim. Perhaps I’m not being artful at articulating my point. Assume you froze all salaries for associate professors and above. Their salaries and benefits would be untouched. Now offer $50,000 salaries for every new assistant professor position in the country. Pretend that the vet schools could collude on this.

What I’m saying is if the university was able to explain as I’ve described above how the PSLF benefit is worth over $100,000 PER YEAR in annual salary to an applicant, what would you do as a newly minted board certified specialist with $350,000 in debt? You could go into private practice and work really hard, maybe do some emergency room work and overtime and POSSIBLY pull in $100,000 a year. After taxes the difference between $50,000 and $100,000 is not $50,000 it’s more like $30,000 anyway.

Now add the fact that the university professor gets tax free loan forgiveness after 10 years of payments and the poor private practice vet has to pay for 25 years and pray the IRS doesn’t force them to declare bankruptcy when they get $1 million of income added to their W-2 in year 25 and owe $500,000 in federal, state, and local taxes, which is currently the law of the land by the way.

You could pay $50,000 per year for assistant professor salaries and still get extremely talented people. Even though they’re earning $50,000 before benefits, after PSLF benefits they’re earning $150,000, and after better university HR benefits are factored in, they’re likely making $170,000 vs $110,000 for the private practice vet. There would be absolutely zero vet med grads going into academia that didn’t have loads of student loan debt, but that would be the smartest way for the vet school to use their resources. Saving 50% on new faculty salaries would go a huge way to bridging the gap between the $30k and $15k state funding bias you mention. Thanks for sharing Jim, enjoying everyone’s comments and the discussion

Private practice speciality boarded Veterinarians are bringing in closer to $250k, some much much higher. You don’t need to to do an internship and residency to begin practicing out it vet school.

Wow! Anybody have data points to corroborate that salary level? I’ve never seen any of my clients make more than around $120k starting, and that includes overtime

It’s hard to get salary point data because the BLS doesn’t differentiate for some reason. A specialist has spent 4 years obtaining their DVM, and 4 years obtaining their specialty, they typically will then have postdoc degree in their field (surgery, neurology, oncology, internal medicine(internists are typically only at academic hospitals)). Many private practice veterinarians are on a ProSal method of pay, so they earn base salary + production. When a TPLO costs $2500 and the surgeon is getting 22% of that, it adds up fast. I’ve never seen a Veterinarian who makes overtime, typically they will be ProSal, with some oncall and callback pay.

“According to the DVM News, the average salary for board certified veterinary surgeons was $183,902 in 2008”

https://www.thebalance.com/veterinary-surgeon-125815

By that info, it sounds like the smart thing to do as a vet med student would be to go the extra 4 years at a university and file for PSLF at the beginning of the program. Then, you would stay at the school as a prof for 6 more years, receive forgiveness, then go into private practice

There were 2687 DVM graduates in the US in 2013, only 70 pass the ACVS boards every year. It’s not that easy. Trust me, I am sure more would do that if the market was there.

Jim’s numbers for private practice specialists is accurate. I have several friends who left teaching at CVMs for private practice and make that much or more.

Then the number one piece of advice I’d suggest to optimize your financial life as a vet with a massive loan balance is try to get employed at a CVM then switch to private practice after 10 years. Sounds like a great lifestyle really as the extra income starts kicking in right around the time most people have young kids

The financial point re veterinary staff is an interesting one and illustrates the point about PSLF but it downplays all the other needs and realities of quality veterinary education so the point gets lost. Eye opening article though.

First of all, new graduates have no place teaching – they barely know anything themselves by the time they graduate. The learning curve in practice following graduation is quite steep.

That’s fair I did write that a while ago. I’ve got a better perspective now

If the assertion that price gouging “isn’t really true” as Jim asserts, but are instead due to issues like the cost of maintaining a teaching hospital then one has to ask why have prices continued to rise at schools that use the distributive model and don’t maintain teaching hospitals just as they have risen at more traditional model schools.

That’s a very interesting point Don. Any chance you could provide some numbers illustrating this? I think it’d be fascinating to compare

I am a vet married to a physician. And while they do have some benefits you mentioned there are some aspects you missed. Physicians graduating now are NOT making 500k out of training, if ever in their careers . At least not if they are ethical and practicing in areas that are at all desirable to live in. Also they make far far less than 80k for all of the years of their post graduation training. Which for most specialists is 6+ years, which is why ibr works so much better for them, their payments are small during training and they make so little they can actually deduct their loan interest. Becoming a vet is a losing proposition financially. But medical school costs twice as much as veterinary school, requiring physicians to take out even more private loans. Then the shortest time they spend training after that is 3 years, in which they barely make enough money to survive on, much less service their debt. The average internists that I know are even making double what I make as a vet, but have a higher educational cost and 7 years of lost earning to my 4. As the “affordable care act ” continues to drive up the costs of health care, physician reimbursement continues to drop. Going into medicine, human or animal, needs to be for the passion of it. Because it is no longer a good economic decision and will only get worse.

My girlfriend is a surgeon, so I can sympathize with the reality that most doctors do not make close to the $500k I used in the article. I was using it to demonstrate the extremes at either end of the spectrum in each professions to show the problem. That said, I think our disability insurance agent told me that she just wrote a policy for a private practice doc in Texas who made $800,000 right out of training.

Med school is a losing financial proposition only if you don’t take advantage of the loan rules. I help human doctors all the time verify they are set up correctly for PSLF, as my responsibility is to my clients. I saved a couple general surgery interns about $120,000 yesterday doing this.

Good points in the article. Thanks for writing this. I’m very thankful to be a public health veterinarian keeping our food supply safe and also very thankful that I enjoy the job. FSIS is not a bad place to work and employs around 1000 veterinarians. Definitely not everyone’s cup of tea though.

What’s FSIS? Yes vets are a key part of America’s economy with raising food to eat. We shouldn’t forget that, perhaps the AVMA should take that line of attack when lobbying Congress to be viewed as part of agricultural interests rather than the red headed stepchild not getting looked out for

FSIS is the Food Safety and Inspection Service, a department of the United States Department of Agriculture.

https://www.fsis.usda.gov/wps/portal/fsis/home

Veterinarians are often employed in public health roles through the government. I believe these positions would also be eligible for the 10 year student loan forgiveness program?

That’s correct they should be. Especially since it’s directly a government agency.

I too am a vet with FSIS. They are the largest employer of veterinarians in the United States…though I think Banfield may be a close 2nd. See website:

https://www.fsis.usda.gov/wps/portal/fsis/topics/careers/opportunities-and-types-of-jobs/veterinary-opportunities/veterinary-opportunities

There are openings everywhere in this agency so I can’t agree with your statement “Veterinarians Have No Eligibility for the Best Forgiveness Option, PSLF”. I am very thankful that we are eligible for PSLF!!!

Wow Bobby, this is great information! I’m really hoping some of the readers here will jump on this if they have huge loan balances. 10 years is a long time but so is a lifetime being buried in debt. PSLF can be a great way out.

I too am a vet with USDA FSIS. The federal government is the largest employer of vets in the US, and there are lots of other jobs available to vets in the federal government beyond FSIS. Unfortunately, a LOT of vets don’t know about PSLF when the join the federal service and many loose months or years before they attempt to find out if they will be able to take advantage of the program. I am trying to work with leadership to reach out to incoming vets proactively to educate them about PSLF. Also, the federal government offers some ‘student loan repayment bonuses’ that new hires unwittingly accept, not realizing it’s not in their best interests to do so if they’re working towards PSLF (since the bonus is reported as taxable income).

I didn’t know that. You’re saying the govt is bigger than VCA and Banfield? That’s pretty incredible to know.

The system definitely needs to change. I don’t know the right answer. Whether it is interest rates and/or limits on money that can be borrowed based on profession. Our first week of vet school at LSU they had several lectures on student debt. The vet schools know it’s a huge problem. I borrowed at total of $150,000 to finish vet school in 2012. I borrowed the money, and I will finish paying the debt by next year. It is taking me 4-5 years, but I have been hustling to make it happen. I don’t expect the government to forgive my debt. I borrowed it and I will pay it. I don’t want tax payers funding my loan forgiveness because I borrowed too much money. I worked emergencies for 3 years after vet school to put a huge dent in my student debt that I knew I was borrowing. I also lived way below my means. My wife and I would make it a game to eat for less that $100 a week for both of us. It’s tough but we made it work, and soon we will start seeing the fruits of our labor.

Some folks borrowing money for school just bury their heads in the sand. When they finish, they are shocked by how much money they owe. Also, they have no plan on how to pay it off, and this huge loan payment becomes a burden for the rest of their life.

Tony, please contact me at travis@studentloanplanner.com because I think I could save you money with a private interest rate refinancing. Like serious money.

This is all so very true. It’s an appalling example of the towering cost of education in our country. As a human physician married to a veterinarian we have been blown away by the fact his school is harder to get into, equally expensive and the compensation is not nearly equivalent. I strongly feel that it does in fact have to do with the AMA, possibly the most powerful lobby group. I have long thought veterinarians need to unite and become more politically active. They need to demand a solution. We need to educate politicians about the problem and push for changes.

The only way this policy problem changes is by action on the part of the veterinarian groups. Many of you probably serve politicians who have pets. Find out who these clients are, and when they visit with their dogs, tell them that many of your colleagues are considering leaving the profession. Write letters to your congressional representatives. Start getting politically active. It’s the only hope really

Directly from the AAVMC “There’s a pervasive myth that getting into veterinary medical school is much more difficult than getting into human medical school, but that’s not supported by the data. ” Please check your facts before complaining that vet school is that much harder to get into. Human doctors graduate with upwards of $500,000 easily and then continue on with 3-5 of residency followed by years of fellowships, just to practice. Do some people go into it for the money? Sure, but most do not. Does it suck that my loans outweighs what I will make in many years to come? Sure, but again not why I went to school. Are all medical students guaranteed a job in non-profit area to use loan forgiveness? Not by any means, but again we practice what we love. If the only reason you go into a school is to make money then you aren’t in the right career and everyone knows that before they sign up.

Almost every doctor in America could qualify for PSLF easily. Almost every residency program is through a not for profit teaching hospital. That’s 4-7 years of credit right there towards the 10 needed for PSLF. If you do a fellowship, that’s 1-3 tacked onto low income based repayments. When you get out, you could go work for a not for profit hospital and pull in 300k (an offer one of my surgery friends actually received), pay 2 years worth of standard program payments, and receive 80% of their debt forgiven tax free.

Doctors do not graduate with $500,000 in debt. If anything, I’ve seen the opposite in my client base. Veterinarians have the bigger balances on average from what I’ve seen. It’s harder to get into A veterinary school than A medical school because there’s only 30 of them, but that might be different comparing Harvard/Stanford med with the top vet schools idk.

No offense but you obviously must not work with a large client base or many clients that are out of state medical school students. Out of state students take upwards of $100k or more every year they are in school as their tuition is double of what in state is to upwards of $70 for the minimum tuition needs, let alone required health insurance, fees, and gear plus living expenses. Per the AAVMC website “Average tuition is $46,352 for out-of-state students, $22,448 in-state students.” and “The most recent American Veterinary Medical Association student survey reports an average total debt of $135,000.” That is vastly less than what you quoted in your article and also less than the average medical student even at in-state tuition which is mean of $183k.

To the point of loan forgiveness, “The U.S. Department of Agriculture offers a Veterinary Medical Loan Repayment Program (VMLRP) that will pay up to $25,000 each year towards qualified educational loans of eligible veterinarians who agree to serve for three years in areas where there is a designated shortage of veterinarians.” I would say serving 3 years is a pretty easy comparison to the 10 that human doctors must do and it also covers the cost of the average in state tuition for veterinary school.

To the point of acceptance rates, the average acceptance rate for medical schools in the US in fall 2015 was a measly 6.9% according to the US News annual survey, whereas the AAVMC data states “Nearly 50 percent of those who apply to veterinary medical school end up attending.”

I can’t speak to the acceptance rate data you quote Rose so I won’t pretend I’m an expert there. I’ve worked with many doctors and their med school debt has ranged from $120,000 on the low end to $350,000 on the high end off the top of my head. The only way someone could take out 100k in med school debt annually for four years is if they’re living like an attending while in school.

As per the Dept of Ag benefit, it says up to. The max benefit is $75,000 over three years, which isn’t going to make enough of a dent in 300,000+ debt loads. No one is trying to demean the human medical profession and blame that group of good people. I’m simply saying that the structure of medicine gives a massive advantage to doctors that the law never really intended. PSLF was supposed to be about encouraging undergrads w 30k of debt to take the job at the nice but low paying community organization down the street. Now, it’s turned into the biggest back door scholarship for doctors in the history of the country.

So how then are these veterinary students ending up with upwards of $350K in loans when they graduate if they are not living as attendings? Lets for instance take into account a veterinary student who ends up $350k in debt because of vet school. Let’s make this an out of state student as they will obviously take out more funds. The average tuition for out of state vet school is $46,352 for out-of-state students per the AAVMC and lets just make that $50k with fees. If they have $350k in debt that means they take out $87,500 each year. 87,500-50,000 = $37,500. Now lets do that same calculation with a human medical student. My husband’s out of state tuition with fees is $76,368.00 (without required health insurance, vaccinations, stick insurance, equipment, and other fees at a public medical school). If he takes out the same $350k over 4 years, his yearly living expenses are 87,500-76,368.00 = $11,132. That is certainly not living like an attending. Even taking the 100K, the yearly living expenses would still be less than that of what a veterinary student would make. Even if you used the average cost of out of state tuition for medical school students ($56,976 per the AAMC), human medicine still lives at lower living expenses taking out the same amount of loans.

Interesting points. If your husband has a lot of loans and is about to become a resident or already is, I could almost certainly help you set up that debt properly so that you get every advantage possible under the loan laws. I also think one thing we haven’t mentioned is undergrad debt. Many veterinarians and medical students too for that matter might go to a pricey undergrad program and add that debt onto whatever they need for grad school. The resulting total after years of compounding on the wrong income based repayment program for someone’s personal situation could easily result in a $400,000 to $500,000 balance whether you’re a human or animal doctor.

I’m sorry but I think many of my colleagues need a reality check. There’s a ton of people in this industry that have a huge inferiority complex with respect to human medicine, and people need to understand that veterinary medicine and human medicine are two entirely different industries. It amazes me how students will knowingly take on 300k in loans to land an 80k/year job and then be upset at everyone else but themselves when they’re stuck in debt for decades. No one forced you to do this. Just because you’ve dreamed of doing this since you were 4 and worked hard through 8 years of college does not mean society owes you a huge paycheck at the end. There’s a lot of things we want in life that we just can’t pay for. If you can’t afford the massive tuition you have two options: do something else, or suck it up and do the best you can knowing that you willingly chose this path.

Anecdotally, it seems like the doctors I know who discount their services left and right tend to be the most vocal complainers about being poor. They will swear up and down that they’re victims of an unfair system when in reality they’re just people with terrible financial acumen.

I have mixed feelings Anon. If you’re not financially literate, I believe you at least deserve a meeting with a counselor before you start school that shows you a simulated loan balance and income in your mid 30s. That would scare a lot of people away, and vet schools need to keep all their students. I’m still waiting on a convincing reason why vet school has to be $300,000 and I haven’t heard one. The state funding decline explanation doesn’t explain it. Someone has to be massively profiting off the explosion of vet med tuition

Oh of course. Many vet schools now have talks on financial management, but they’re conveniently occurring after the student signs on the dotted line. They’d never have that sort of discussion with prevets precisely because it would kill their enrollment numbers.

And yes I think most would agree that there’s a profit made on the 300k tuition. But given the nature of the veterinary industry as a whole (mostly disposable income), I think change will and should come from students choosing not to trap themselves in that sort of debt. I highly doubt that the government will make things more “fair” for us in the future. If anything, they’re going to eventually clamp down on the amount of loans vet students have access to, and either there will be fewer vets with more pay or the tuition will come down. Something will give.

I find that the financial aid counselors are employed by the universities a major conflict of interest. What incentive do you have to tell someone it’s not a smart economic incentive to go to vet school? There’s zero. I think there’s an analogy between having independent loan counselors to the independent concussion experts in the NFL now

I am a Human Resource Manager for a State Department of Agriculture and find it very difficult to find Vets. I’m new in this position but understand the problems that a recent graduate faces because my son is a vet and is experiencing the same inequity. He himself said he couldn’t work for us at the salary we offer, support a family, pay a moderate house mortgage and his student loans.

What are we thinking !! A vet in this position ensures the safety of the food we eat. You’re not dealing with companion animals here. It’s serious business. I am looking into the loan forgiveness program to entice a vet to take the position. We have one vet and I’m afraid she’s going to burn out on us.

You get what you pay for. Honestly this whole debt situation is really a blessing in disguise since vets will finally start demanding to be paid what our services are truly worth (ie walk away from crummy salaries). That or some public health disaster will happen and the government will shape up their act.

Though, the other side of this is that owners can only afford to pay, based on what the associate is able to produce for the practice – typically that number is now, in 2018, approximately 20-25% of what the associate produces which includes their benefit package. (in a general practice – in a specialty practice it is 25-30% of production including benefits. ) i.e. if the gp associate produces $500K then their compensation package should be in the $100-$125 range – if they produce $750K, then it should be $150K -$187.5K – and so on. It has to make sense for the practice owner or there is no point in taking on an associate and the additional HR headaches that come with additional staff (support staff and associates.).

Fred please feel free to contact me at travis@studentloanplanner.com. You could literally market your position as having up to a $70,000-$100,000 per year benefit through the PSLF program. Loans are not being forgiven until Oct.2017 so most people still do not know about PSLF yet. I imagine you will never again want for veterinarians once people figure it out.

Oh my gosh, as an undergraduate senior planning on vet school, this is infuriating. I had no idea that this was a problem and I’m so glad a friend of mine shared this article. Thank you for taking to the time to write this!

For sure Tory. Be extremely careful. Go in with eyes wide open because no one in the financial aid office will tell you the truth about how veterinary school is a questionable financial decision if you have to finance it completely with debt.

Hi Tory. I recommend taking a year off after graduation (most schools let you defer for a year) and working full time in practice to make sure it’s what you really want and that you can live with the reality. Talk to the vets and do a budget based on the low end of the starting salary range in the area where you want to live. Factor in paying loans, some of your own professional fees (employers vary in how much they cover; and I pay my own liability/ license defense bc I don’t trust my employer’s plan to put my best interests first ) and health insurance premiums (some employers cover this; many don’t, and some cost sharing is common).

I don’t necessarily hate being a vet, but I’m close to burn out with the constant pressure at work and living with debt. With just an undergrad degree, I’d make less total but be financially ahead by far when I factor in loans. My car is almost old enough to vote, and I have a pretty tight budget with little room for error. I’m not saying don’t be a vet, but take a hard look at the sacrifices you’re going to make and realize that they’ll look less tolerable as you get older.

Great advice. If possible, entering REPAYE early during that year would be great because it could result in $0 monthly payments and would pay for 50% of all accrued interest. Perhaps a parent could afford to treat you as a full time employee in some regard to take advantage of this provision.

Thanks for pointing out some of the differences we see between physicians and veterinarians in regards to student loan repayment. This is an issue the Veterinary Information Network (VIN) and the VIN Foundation has been studying for a number of years as we’ve counseled and educated hundreds and thousands of veterinary students and those in repayment. We’ve built a student loan repayment simulator that is specific for the veterinary repayment situations that you have described here and it is publicly available at http://www.vinfoundation.org/loansim. I would encourage you to run your “Sarah” REPAYE simulation through it because I get a much lower repayment cost than you have published here. One of the things we educate veterinarians on is how they can utilize income-driven repayment to build a financial wellness plan. While it may not be ideal or come close to the physician scenario, it can be workable whether you work towards PSLF or not. Travis, I’d love to compare notes sometime on your veterinary student counseling experiences so we can work together to get the best information possible to veterinarians.

Happy to speak with you Tony. Just email me at travis@studentloanplanner.com. I looked into your calculator. Very impressive functionality. The differences in our numbers are due to the assume tax rate and income growth rate. I didn’t mention joint marital income but that would affect the total numbers too if Sarah had a partner. You guys use a default of 30% I keep it at the highest current rate of 43.4% federal and 5% state because that income will probably push most people into the top bracket. The REPAYE numbers are of course highly dependent on income growth as the monthly amounts will grow with income.

Would love to get your thoughts on what happens when the first round of veterinarians qualifying for PSLF gets their debts forgiven this year (2016) and the government realizes how much money they’re losing? Seems to me that the program is in danger of begin retracted really quickly after this year. As a veterinary student who plans to specialize and remain in academia and would like to benefit from the program if possible, the thought is nerve-wracking…

Kelsey are you currently in repayment or are you still in school. Here’s my thoughts. The only people who’ve sought repeal of PSLF are the House Republicans. They exempted anyone currently in the PSLF program though from the repeal in the legislation that failed. Pres. Obama sought to limit the PSLF benefit to only $57,500 in a recent budget proposal, but that failed too. Clearly, both sides want to reform the PSLF program but if I had to bet my finances on it I’d guess that it would be around for me as long as I had applied with the PSLF employment certification form. This is what I talk through in consults at trais@studentloanplanner.com too is what would your life look like under different legislative proposals. Risk tolerance definitely comes into play.

Another point is that the first round of loan forgiveness happens in October 2017, not 2016. So we haven’t even begun to see what will happen. Congress has not appropriated money for this benefit, so it will be stunning when it happens. I would imagine a major student loan overhaul when Congress starts getting the bill, which will force them to ask “what the heck did we do?” I still would bet on anyone in the program being able to stay in it

I think you understand the idea behind the financial aspects very well, but lack the understanding that is associated with the veterinary side of things. A few things that you had mentioned earlier:

First, the absolute last thing we need in this profession is more vet schools. The increase in the number of vet schools, first off, has not lowered the bar on tuition costs. In fact, new vet schools tend to come in at higher than average prices, and many of them don’t offer an IS option. Also, if we keep making vet schools that pump out more vet students, when there is not a need for vet students, you will see the salaries start to drop as well. Which will make a bad situation even worse.

Second, the idea behind paying a DVM/PhD or board certified resident a wage of $50,000 is ludicrous. I understand, from a purely financial perspective, what your thoughts are. Yes, PSLF will make it so it is in the long run better than the private vet. However, you are forgetting that this represents a small subset of students who dedicated an ADDITIONAL 4+ years of their time. When you were talking about it being fair that the average veterinarian makes more than the average person, it should be fair that the average board certified veterinarian or DVM/PhD makes more than the average veterinarian.

Third, the idea of hiring new grads to teach vet students is once again a completely unfeasible idea. First off, the veterinarians present at institutions are primarily the ones that are doing research within the field of veterinary medicine. They have been taught, through either their residency or PhD, how to engage in research, write grants, write research paper, etc. This training does not occur in vet school. Also, these veterinarians are not equipped to teach veterinary students. They have just gotten out of vet school, they do not have the experience in order to be teaching students at this point.

Also, vet schools are not gouging students (at least not public vet schools). Public vet schools are suffering from decreasing funding from the state, and many of them are simply trying to keep themselves afloat. Remember that charges to clients associated with public vet schools tend to be less than surrounding private practices

WIth regards to PSLF options, there are several for vet students that are interested. Whether it is through the USDA (APHIS/FSIS), working at a public institution, or others, the opportunity DOES exist. The “loophole” that you claim is also obtainable for vet students, given that they can utilize it on at minimum their residency at public schools (internships depends on how the student is classified for tax purposes), and they can engage in fellowships after residency as well (and then work for an institution for several years).

With all that said, the situation for students is very concerning. Everyone’s mother, brother, and sister is trying to make a new vet school as of late, and although the AVMA is starting to put their foot down on the number of vet schools, there is only so much they can do given their current bylaws (they theoretically “must” accept any vet school that meets the criteria for accreditation). PSLF is looking like its on its way out, meaning a very viable option for paying loans back will be most likely gone for students starting in the next few years.

A very realistic solution to this be the federal government is capping the amount of interest that can be accrued at a certain amount, say $50,000. Given this, those with the $300,000 debt you cited in the article, would not have to deal with accrual to $600,000+ as you stated, and could have a MORE MANAGEABLE debt to deal with. Is this a perfect solution? Not by any means. But it is a solution that would still allow a return on investments by the government, which would appeal more to the Republican side of government.

Such a return of $50,000 compound interest on $300,000 in debt over 20 years amounts to less than a 1% interest rate. I don’t forsee any interest cap coming forth in legislation any time soon.

I definitely defer to all the veterinary professionals here for knowledge of the profession, as mine is limited. I did not know about the huge number of positions available with the Dept of Agriculture that could be used for PSLF. I’m glad something exists out there. For the urban centers where most veterinarians want to set up practices though, there are virtually no not for profit positions. Compare that with human medicine where almost every single job is a full time contract at a qualifying PSLF hospital employer, and that’s the crux of the unfairness.

As to salary, I agree $50,000 a year is insulting to someone with so much education and training. However, with the PSLF benefit those folks would not be earning a $50,000 salary. They’d be earning a $50,000 plus $70,000-$100,000 a year salary. Like I said you just would not be able to hire anyone with a low or no debt level at that rate.

Well, then don’t become a veterinarian…

Unfortunately, that’s the message that will be communicated to potential vet med applicants after reading the horror stories from articles like this.

Travis, I read your article with great interest. I graduated from veterinary college in 2008 and thought I would be able to utilize the PSLF program. But life situations and demographics did not allow me to do so in the beginning. I did leave private practice and worked for USDA FSIS for two years, but found the work so intellectually non-stimulating and the governmental bureaucratic red tape nauseating that I had to leave.

I do believe that there are a number of issues at play here. First, I have made it a priority to educate young prospective veterinary students about the cost of the education and where salaries currently stand. There are options with the U.S. Army to get a full scholarship and enter the Veterinary Corps upon graduation where jobs are available working with military dogs or in public health. Further, numerous schools including my alma mater have DVM/Ph.D. combined programs where the graduate school at the veterinary college pays your tuition fees while you pursue the DVM and Ph.D. concurrently. This is obviously directed towards a student interested in basic science research and not private practice.

Additionally, most graduating veterinarians today are women. For instance, my class had 16 men and 74 women. I mean nothing negative by saying this, but let’s face it, many women want to get married and have children eventually much like my wife (who is also a veterinarian). When child bearing comes into the mix, earning potential declines dramatically and those student loans are even more ridiculous. Many women don’t realize after graduating how little money they can make working part-time while they try to balance child rearing and working in private practice.

All that being said, our culture has a serious spending and free wheeling credit problem. My wife and I combined owe $250,000 in student loan debt; however, we are currently on a plan to pay it back in four years. I found through calculation that keeping my USDA FSIS job at such a low pay would actually lose me money over the ten years I needed to stay. I currently make about $30,000 more as an emergency veterinarian at a private practice. I am also making extra income working as a relief veterinarian at other practices in my area. With good budgeting skills and spouse communication (which we did not learn in veterinary college), my wife and I are going to kill this debt fast! Many people do not even consider that a large loan balance can be repaid in quick order if they don’t buy stuff they can’t afford (like new cars) and they live within their means. Unfortunately, many working class people spend like our government does and we all know how ridiculous that debt is.

If your plan is to pay it back I could probably help you Jonathan either now or in the future when your combined debt to income ratio gets low enough to refinance your 6%+ loans to a better rate. The average I’m seeing for emergency room veterinarians right now is about 4.5% which is significant savings on 6.8% loans many people have

Wow – your article is so right-on. Our daughter is a vet. Neither my husband nor I went to a 4-yr college so we stressed higher education to our daughters from a very young age. How proud we were when our daughter got into vet school at a young age. Our state, Connecticut, does not offer any vet studies nor does it have a tuition reduced partnership with any states that do have a vet school. We had not choice but to take out loans. Never in our wildest dreams did we realize the magnitude of those loans when compared to the salary she is making. She is scared and so are we. It is a shame we were so naive. I would – and do – tell people who express interest in vet studies for their children to make sure they have the finances to back it up. Thank you for your article – I just wish I had seen it 6 years ago.

Thank you for the kind words Kathy. It’s totally understandable because vet schools do nothing to explain how economically devastating vet school loans can be. At least there are options for folks who already have the debt burden so that they can continue practicing what they love

It does suck that federal options aren’t available, but a ton of individual states do offer forgiveness or repayment programs!

None that can handle $300,000 of veterinary school loans though unless you know of some Femme. There’s several that will give folks a decent four or five figure sum but nothing like the federal PSLF program. Thanks for commenting!

Great article. I am a second career student and was pretty well aware of the financial consequences of taking out student loans at my age (let’s just say if I’m lucky and my family history holds out, I will live to the average age of most Americans.)

While I still cringe at the amount I will owe upon my soon to be graduation date, there are a few factors that made it a bit easier to make a decision to quit the slog of being a corporate drone (which I did for 15 years) and delve back into school. First, I do not have, nor wish to have, any children. I have never been a person who needed luxuries (if a car gets me from point A to point B safely I don’t care what it looks like or how old). I don’t plan on spending a fortune on a wedding (did the wedding thing at a very low cost in the past, again by choice). I am a thrift store junkie (and if I say so myself a pretty fashionable one at that). I wasn’t making a ton of money in my former career, so I learned how to save wisely and did manage to squirrel some away in a savings plan. I do not have any outstanding undergraduate debt. I’ve never put money down for a mortgage, and not sure I ever plan to (whether that is wise or not is up for speculation…) I am the only child of two parents who have also been very skilled at living within their means, they never had a luxurious life but a happy one. I am not a total saint, I do still spend foolishly sometimes, but try to keep it realistic (sometimes we all need a little feel-good reward!) I feel lucky to be where I’m at, but still disappointed that more isn’t available in the way of creative debt repayment options. Parts of the nonprofit sector can have high turnover due to burnout (think animal shelters) and the military options are great but pretty competitive and not really an option for an older student like me. I can only hope that the veterinary profession steps up to address the financial situation of its graduates, which I believe they are starting to do. The VIN calculator is a good start (excellent resource that was made known to us at my school early on). There is a real issue in this profession with burnout and financial stress is a huge part of that. More vet schools is not the answer, as was well-stated above by another commenter and pretty well known among students. I realize I don’t have as many years as younger graduates to pay off my debt, but I’ll be trying everything I can to ease the burden and try to enjoy this career…or end up never being able to retire except by dying…but that’s a whole other conversation in itself! Thanks for talking on a good topic and sparking the discussion.

Some folks blow a ton of money on new cars, big houses, etc. I can think of a lot of things far worse to spend money on than an education to do a job you’re passionate about. Veterinarians just need to know how they can tackle their loans and be aware of what they’re getting themselves into, and just hoping to further the conversation

This article does not mention the ability to work for the USDA Food Safety and Inspection Service. Which currently has a roughly 10% vacancy rate. They are dying to hire vets and it’s PSLF approved.

Agree that the rest of this is true though. Very sadly true.

I should add the FSIS to the article thanks for the suggestion. I’ve seen a few vets qualify working for shelters but it’s somewhat rare.

The student loan forgiveness is taxed by the way, no tax free

This does not have to be the norm. I graduated from vet school with minimal assistance from parents and are on path to pay off loans in 3 years. As long as you live within your means the profession can be lucrative, but obviously not as great as medical school

Did you go to an in state school or a private school? I would agree that it doesn’t have to be that way if you go to the right school. However, if your 22 year old self wants to go to vet school and you just go to whoever accepts you, you’ll wake up and realize it’s basically impossible to pay the debt back if you borrow it fully.

There is a reason the government steps in when it’s comes to medical/medical education. People need Physicians, people don’t need veterinarians. One is a necessity to society, one is a luxury.

I don’t agree. Even if you write off the work vets do for cats and dogs, there are a huge number of veterinarians who are working for the federal government with the FSIS to keep our food supply safe. That’s just one example.

Thank you for writing this!!! It isn’t worth being a Vet anymore! https://www.pawbark.com/is-becoming-a-veterinarian-worth-it/

Thank you for bringing awareness to this topic. As a veterinarian it pains me that so many young people now MUST stay away from the profession because of the crippling debt it could impose. I would prefer to encourage young people who have a passion for animals and science to consider a career in veterinary medicine but unless they have huge college savings to fund their education, it makes no financial sense to do so. Heart breaking!

Hopefully the universities will reform themselves, otherwise a declining applicant pool will do it for them.

[…] I came across an article by Travis Hornsby that put my school loans into perspective. I reached out to him for a consultation and we were able […]

I am a young veterinarian (graduated in 2017) with some advice for those that want to be veterinarians or recent graduates with debt.

1. Go to your in-state institution or establish residency in a state with a veterinary school and DO NOT go to an out-of-state or island/for profit veterinary school. This is the first huge financial mistake most will make. If your family will pay for your veterinary education then fine, but most financially stable/able families do not gain financial security by making poor financial decisions of paying for unnecessary educational expenses. It took me 3 attempts to get into my in-state institution and this has saved my several hundred thousand dollars. Don’t be driven by emotion; be driven by financial practicality and common sense.

2. Live under/within your means. Do not borrow more money than you need just because you can. Do not buy things you do not need, don’t get a fancy apartment by yourself (get roommates and cut costs while in school). I drove a 20+yo car and did not have TV or a smartphone throughout college/trade school/grade school/vet school and had roommates every step of the way. Do work if possible and do not eat out- buy groceries and cook in bulk for the week instead.

3. Once you graduate, consolidate & refinance your loans. This simply means trading one interest rate for the other. I advise a fixed rate loan over a variable rate (the interest rate on variable interest rate loans tend to go up over time and not down). You can/will save tens of thousands of dollars in interest by doing this. However, these private loan interest payments cannot be deferred like the government loan interest payments which occurred for the latter during the COVID-19 pandemic.

3. Apply for USDA VMLRP loans (you probably won’t get it, but it’s a free application for free money). These are regional loans for mixed animal/large animal practitioners in designated veterinary service shortage areas. I was denied my first year out of veterinary school (according to the selection committee, I did not have enough experience. By the time I have enough experience, I will have my loans paid off). It can’t hurt to try.

4. Change jobs for higher pay. Don’t be afraid to change jobs for better compensation or a better environment. Mental and financial health should be your priority.

5. Move back home/live with relatives if possible. This sucks, but free rent allows you to pay more on your loans and get out of debt faster. It is a huge sacrifice and annoying, but worth it if you value financial independence.

6. Don’t get more pets/have kids/spend a lot on a destination or regular wedding. I had classmates accumulate animals in school. This is an unneeded expense for someone already living on someone else’s dime. Also, having children is expensive and doing so while owing Uncle Sam 250k is not a good idea. If you get married, don’t be lavish and over-the-top. My grandparents got married at the courthouse before he got shipped off to war in WW2 and they’ve been married 70+yrs.

7. Offer to work extra hours/Do relief work/be on call. Strange as it may seem, the more you work, the more money you can earn. Doing ER work on your weekends off/holidays can significantly supplement your income (I earned over an extra 5K last month doing ER relief work). This is very feasible for someone who does not have children/a spouse if one is willing to work more than their ~40hr GP job. There are plenty of relief opportunities out there, and many will cover cost of travel and hotel expenses.

I recognize everyone’s situation is different, but anyone can make changes to their lifestyle/spending habits and make more financially prudent decisions. This has allowed me to pay 2-5k per month towards these loans while still allowing me to contribute to a savings account, an IRA, and emergency fund. I don’t have a nice car, a house, or lots of material goods, but I will have my loans paid off in <1yr and have peace of mind and financial independence/security. This has obviously come with a lot of trade-offs and sacrifices. For perspective, I did not graduate vet school until I was 30yo and came out owing 150k. I am single/not married, have one dog, and live at home with my parents (for the time being). I purchased my first smart phone in 2019 and have made minimal other large purchases (a laptop, some guns). You will find you really don't need much to get by.