An income-driven repayment (IDR) plan can lower your federal student loan payment and open the door to various loan forgiveness programs. But with so many changes to federal loan plans and the chaos of life, some borrowers might not know which IDR plan they’re currently making payments on.

Depending on which IDR plan you’re enrolled in, your payment amount will generally be capped at 5% to 20% of your discretionary income. So, it’s important to verify your income-driven repayment plan and take steps to enroll or switch plans, if needed.

How to verify your income-driven repayment plan

The student loan system is complicated, and it frequently changes. Plus, a lot of borrowers experience anxiety and other mental health effects from their student debt. Some borrowers choose to ignore or allow their servicer to primarily manage their overall student loan repayment.

All that to say, don’t feel any type of way if you aren’t in tune with what repayment plan you’re on. It’s common and understandable.

If you aren’t sure which IDR plan you’re on, there are a couple of ways to verify your enrollment.

Get Started With Our New IDR Calculator

Download your NSLDS file

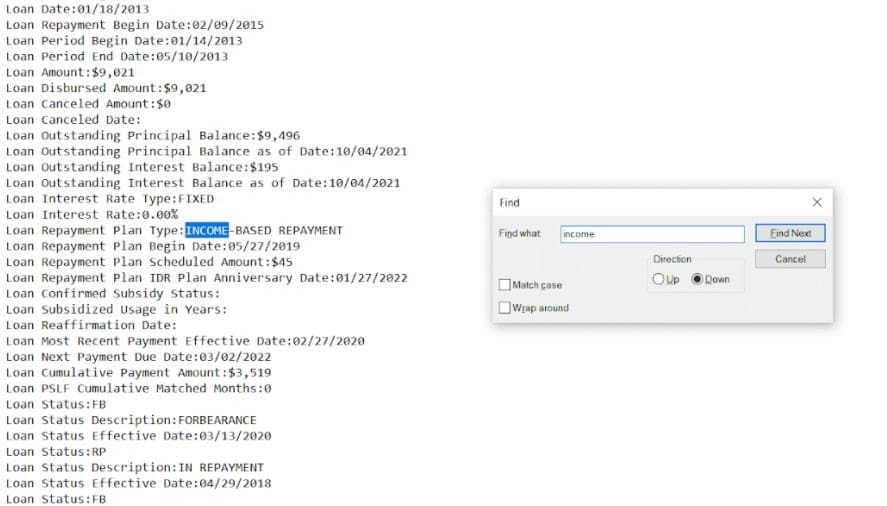

The most accurate way to confirm your IDR plan is to download your student loan file from the National Student Loan Data System (NSLDS). This is the official record with the U.S. Department of Education for your student loan activity. It exists separately from the payment data stored with your loan servicer and can be accessed through the federal student aid website.

Be warned: this file isn’t exactly user-friendly. In fact, it can be pretty intimidating if you’ve never seen it before. There’s a lot of text with zero visual appeal. But we have a shortcut to find your income-driven repayment plan information (or any other data you’re looking for).

Hit CTRL+F for a keyboard shortcut that brings up the find box. Then, type in the names (or partial names) of each repayment plan. There are currently four IDR plans including:

- Saving on a Valuable Education (SAVE), which used to be Revised Pay As You Earn (REPAYE)

- Pay As You Earn (PAYE)

- Income-Based Repayment (IBR)

- Income-Contingent Repayment (ICR)

In the example below, I searched ‘income’ which brought up every instance that income-based repayment appeared for the IBR plan. You can also search terms like ‘revised’ and ‘pay as you earn’.

To avoid scanning a bunch of gobbledygook, don’t search for generic terms like ‘repayment’ or ‘pay’. This will tag a bunch of unnecessary areas you don’t need to spend time filtering through.

Check with your loan servicer

Alternatively, you can check with your loan servicer to verify which income-driven repayment plan you’re enrolled in.

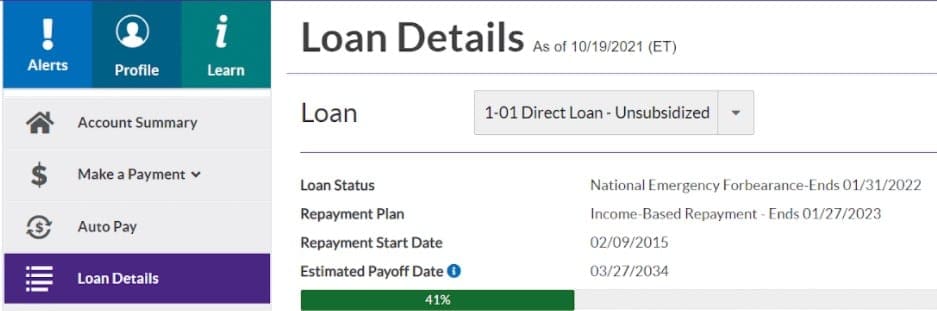

Log into your online account and look for an area that includes your loan information.

For example, if Aidvantage is your current loan servicer, you can use the ‘Loan Details’ menu option and then select each of your individual loans to confirm your IDR plan enrollment.

You can also contact your loan servicer directly to discuss details about your IDR plan, such as your remaining loan balance, number of qualifying payments, deadline to recertify and alternative repayment options.

4 Steps to enroll or switch IDR plans

If you find out that your federal loans aren’t enrolled in an IDR plan or that you’re making payments on a less advantageous plan, you’ll need to take action.

Start by exploring IDR plans to determine eligibility requirements for each plan. You’ll also want to choose a plan that aligns with your goals (e.g., get the lowest monthly payment amount, maximize forgiveness, etc.).

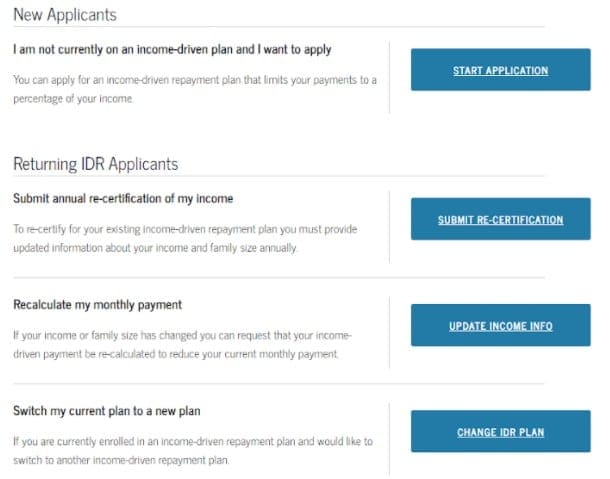

To enroll in an initial IDR plan, you’ll need to submit an income-driven repayment plan request using the IDR application. Here are the steps to do so:

1. Login to your studentaid.gov account and select ‘Start Application’ under the ‘New Applicants’ option.

2. Provide basic personal details regarding your employment, family size and marital status.

3. Submit IDR income verification via the IRS Data Retrieval Tool that connects to your most recent tax return. You can also submit alternative income documentation, including pay stubs or a signed statement detailing your financial situation.

4. Continue making your required payments until the IDR plan is approved. You can also request a temporary forbearance with your loan servicer while your application is being processed.

If you’re already enrolled in an IDR plan but want to switch to a different plan, be sure to select ‘Change IDR Plan’ under the ‘Returning IDR Applicants’ option. Provide the same requested personal and income information, and then continue making your current IDR payments until you’re approved for the new plan.

Choose a strategic IDR plan

Income-driven repayment plans are designed to provide financial relief for federal student loan borrowers by providing lower monthly payments and loan cancellation opportunities. They give you options whether you’re struggling to make payments or simply prefer to pay as little as possible toward your student loans each month.

But they aren’t always the best repayment strategy for everyone. For example, many borrowers choose to refinance student loans to a lower interest rate. Then aggressively pay them off for mental peace. If you have private student loans, you'll want to look into refinancing options anytime your credit improves or interest rates drop.

However, other borrowers will benefit greatly from maximizing student loan forgiveness under an IDR plan or through the Public Service Loan Forgiveness (PSLF) program. Additionally, there are financial strategies that can dramatically reduce your IDR payment by lowering your adjusted gross income (AGI).

If you need help choosing a repayment strategy, book a one-hour consult with our team of student loan debt experts. They’ll review your NSLDS file and provide you with in-depth options to maximize your finances.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).